Ohio’s largest utility wants to slash compensation for rooftop solar owners — which would affect not only future investments but also thousands of regulated utility customers who have already installed panels on their homes based on existing rules.

Later this year, the Public Utilities Commission of Ohio will decide whether to keep its statewide net-metering rules intact or whether to switch ratepayers to a less lucrative program proposed by American Electric Power’s Ohio utility.

The changes put forth by the utility are drastic and would raise costs and discourage others from going solar, a broad range of critics say.

“In a time that people are struggling to pay their bills, they are trying to gut net metering, which is one of the ways folks who are able to [can] save money by putting solar on their rooftop,” said Nolan Rutschilling, managing director of energy policy for the Ohio Environmental Council.

AEP’s proposal will be considered as part of the PUCO’s ongoing five-year review of the state’s net-metering rules. Parties’ case filings were due last month, although public comments can still be submitted.

The rules apply to the state’s investor-owned utilities: AEP’s Ohio Power Company, Duke Energy Ohio, AES Energy Ohio, and FirstEnergy’s three Ohio utilities. Ohioans have added more than 20,000 residential solar projects statewide since the current net-metering rules took effect about seven years ago, according to data from the sustainability consulting group Unpredictable City.

In effect, AEP wants to include distribution charges for all electricity flowing into a solar-equipped household, even if a big chunk winds up going back to the grid. The company describes the change as a shift from net usage to net billing. And it wants to limit net metering to customers who don’t pick their own electric generation supplier or take part in a community aggregation program.

The reduced compensation could substantially lengthen the payback period for rooftop solar investments.

“Residents that have already invested in solar have taken on the upfront capital cost because of the long-term utility savings supported by net metering requirements,” Casey Shevlin, director of sustainability and resilience for the city of Akron, wrote in a comment. “Their consumer rights need to be protected from net metering changes that could result in them benefiting less from solar investments they have made.”

Battles over net-metering rules have played out recently across the United States, including in the leading rooftop solar market of California.

There and elsewhere, critics of net metering argue that it forces the average customer to overpay for rooftop solar’s extra energy and that net billing is a fairer system. Supporters of net metering say that it provides systemwide cost savings by increasing distributed energy and that it’s a proven tool for deploying and democratizing clean electricity.

Among utilities, only AEP has formally opposed the recommendation by the commission’s staff to keep net-metering rules in place. The company’s proposal is supported by the Ohio Consumers’ Counsel, which said it wants to ensure there’s no “cost shifting” to people without rooftop solar.

But the AEP proposal has received massive pushback from environmental advocates, business groups, local governments, and others since its filing on the day before Thanksgiving.

The Citizens Utility Board of Ohio, Interstate Gas Supply, the Retail Energy Supply Association, Solar United Neighbors, the Ohio Environmental Council, and the Environmental Law & Policy Center have all filed formal replies with the PUCO, urging regulators to reject AEP’s arguments and to keep the current net-metering rules in place for all ratepayers.

AEP’s Ohio media relations office wrote via email, “Under net metering, a portion of the distribution-related charges are essentially shifted to other customers when the charges are calculated only for the net portion of the electricity delivered,” because infrastructure costs “are designed to be spread across the customers the system was built to serve.”

The company did not respond to Canary Media’s request for data showing how it or other regulated utilities would be hurt by net metering for customers who pick competitive energy suppliers or take part in community aggregation programs. The company has come after net metering before — and ultimately lost.

More than a decade ago, AEP took its arguments to limit net metering to the Ohio Supreme Court. The court ultimately dismissed that case after the PUCO released new rules that generally favored the company. A year after hearing lawyers’ arguments urging it to reconsider those rules, however, the commission changed course.

The current policy, adopted in December 2018, requires regulated utilities to compensate all rooftop solar customers for excess power, but it does not allow credit for distribution charges or for any avoided capacity charges.

AEP’s gambit to change the rules now surprised advocates for renewable energy, such as Mryia Williams, Ohio program director for Solar United Neighbors. “The PUCO staff had already concluded that net-metering rules are working as intended, and they didn’t think any changes needed to be made,” she said, referring to a Nov. 5 administrative law judge’s order in the rules docket.

The utility has not offered any data or other detailed assessment to justify its proposed changes, Williams said. And many rooftop solar owners relied on the current regulations when calculating whether to make the investment. “Everybody is just wanting to make sure that what’s already been promised is continued,” she said.

Plus, rooftop solar customers already pay for equipment to feed excess power to the utility. Levying distribution costs for electricity that customers wind up feeding back to the grid would, in effect, charge them for supplying the utility with distributed energy. Other energy suppliers don’t have to pay that expense, so it shouldn’t be something utilities can charge residents for either, said Nat Ziegler, manager of community solutions for Power a Clean Future Ohio.

Moreover, reducing net-metering compensation and limiting who can get it would discourage more people from adding rooftop solar, said Joe Flarida, executive director for Power a Clean Future Ohio.

“More generation on the grid will help limit the amount of price increases we’re seeing,” Flarida explained. “Certainly, if we can encourage more distributed energy, that would offset the amount of added power we need on the grid.”

Power a Clean Future Ohio is among the hundreds of groups and individuals who filed public comments with the PUCO, in addition to the formal party filings. That level of response represents a big change from a decade ago, Rutschilling said, noting increased interest in rooftop solar over the past few years.

People’s electricity bills have already jumped dramatically as grid operators like PJM have sounded the alarm about needing more electricity to meet demand from data centers, increased electrification, and other factors. And results of the most recent auction will almost certainly increase costs even more.

A bill introduced last fall would declare it state policy to “ensure affordable, reliable, and clean energy security,” with “clean energy” specified as meaning electricity from nuclear or natural gas, with no reference at all to renewables. But any new nuclear power requires years of review, and even with expedited permitting, Rutschilling noted, orders for new natural gas plant turbines have lag times of several years.

“We need as much generation as possible,” he said. “We need to have things like distributed energy.”

Last year, I made a habit of checking the live feed of a particularly pitiful webcam.

The view showed a muddy gravel lot bisected by a chain-link fence in the coastal marshes of southern New Jersey. No person or vehicle ever entered the frame, though I half expected the site to be bustling with activity as the state transformed it into a billion-dollar port for offshore wind.

Only once when I checked this live feed did I see something different. On a summer evening, I logged on and the camera panned to another angle, which showed an adjacent site where some construction work on the New Jersey Wind Port had started and then stopped. A view of the vast Delaware Bay loomed in the background. I watched the sun set over the half-built, now-abandoned port.

Some metaphors write themselves.

The Garden State megaproject, championed by former Democratic Gov. Phil Murphy, is just one offshore wind project among many that were disrupted by the Trump administration last year. Throughout 2025, the federal government clawed back federal funds, sunsetted wind tax credits, and froze permitting for wind farms. It ended the year with a bang: About two weeks ago, the administration issued a sweeping stop-work order to all five offshore wind farms under construction in the U.S.

The fall of New Jersey’s offshore wind port mirrors the fate of planned wind farms, ports, and manufacturing sites that many states, particularly in the Northeast, had spent decades building up.

Still, multiple experts told Canary Media it was inaccurate to call the industry “dead.” At least one described the state of affairs as a hibernation — and as a key time for “learning” before the next wave of activity.

According to some analysts, it’s not easy to see when — or if — that next wave of offshore-wind activity will come.

When Donald Trump was elected last November, BloombergNEF expected the U.S. to build 39 gigawatts of offshore wind by 2035. BNEF’s latest forecast, released in October, expected just 6 gigawatts to be built by 2035 — an amount equivalent to the capacity of those five wind farms that were under construction and America’s only fully completed project, New York’s South Fork.

Even that may be optimistic if Trump’s late-December stop-work order results in cancellations.

In other words, according to BNEF, it’s possible that no new wind farms will break ground in the U.S. for the next decade. Even with a recent court ruling deeming Trump’s permitting freeze “unlawful,” developers would struggle to finance projects that aren’t already underway, analysts say. It’s also hard to imagine why an offshore wind developer would bother trying to get a new project off the ground while Trump is in office, given the level of turmoil and explicit ire.

“We think the risks are inherent to the Trump administration,” said Harrison Sholler, an offshore wind analyst for BNEF.

The sector also faces cost pressures both related and unrelated to Trump.

Even before 2025, pandemic-related supply chain issues, rising interest rates, and inflation had all made it more expensive to build offshore wind in America, Sholler said. In fact, those pre-Trump macroeconomic conditions caused a few projects to collapse during the Biden administration.

But the cost issue has gotten worse, not better, since Trump was sworn in last January.

Take New Jersey’s wind port, for example: The $637 million state-backed project broke ground in 2021 and was supposed to be a staging area for two wind farms planned for the Garden State’s coastline — Atlantic Shores and Ocean Wind. Days after Trump took office, Atlantic Shores began imploding when co-developer Shell pulled out and the New Jersey Board of Public Utilities declined to grant the projects a power purchase agreement. Both Shell and the utility board cited “uncertainty” over federal actions. And in late 2023, developer Ørsted pulled the plug on Ocean Wind and its port commitments because of rising costs. The port’s fate is uncertain, and its webcam appears frozen.

Overall, “offshore wind has gotten one-third more expensive based on our modeling, and that doesn’t include the effects of tariffs,” said Sholler, who explained that the cost increases in BNEF’s latest calculations were driven by Trump’s July move to phase out federal tax credits much earlier than the date previously set by the Biden administration.

Offshore wind, as a sector, has had bad timing in the United States.

The Biden administration started issuing full project approvals about a year into the Covid-19 pandemic, which had scrambled supply chains and sent interest rates soaring. Amid these economic hurdles, the U.S. charged forward with offshore wind anyway.

Elizabeth Klein, former director of the Bureau of Ocean Energy Management, defended the pace at which the federal government permitted new offshore wind farm projects, even as financial conditions worsened.

“It was incredibly important to get as many projects permitted as possible so we can build some proofs of concept,” Klein said.

But that might have been a mistake, according to Elizabeth Wilson, a wind energy expert and professor of environmental studies at Dartmouth College, who said state and federal leaders should have slowed down wind development during that time instead of leaning in.

“We were building a whole new sector … Building it as rapidly as we had hoped to do was even more ambitious,” Wilson said.

America’s offshore wind industry, Wilson said brightly, is now in a “learning phase.” And considerable learning, she argues, has already happened: State governments are currently more equipped to grow and manage offshore wind power than they were five years ago.

Wilson and three colleagues published a study this month demonstrating that U.S. states, even prior to Trump 2.0, were already “drawing lessons” from the challenges they encountered while trying to launch the nation’s first offshore wind farms.

In New York, for example, state regulators adapted the way they price power purchase agreements to better account for rising costs. In New Jersey, an early oversight in transmission planning led to new requirements for offshore wind developers to show how they would better coordinate transmission across the regional power grid. And throughout the Northeast, state governors — working with federal regulators — identified better processes for compensating fishermen for lost revenue due to wind farm construction.

It’s unclear what learnings will arise from Trump 2.0, but Wilson offered a few preliminary suggestions.

First, regulatory stability is paramount, especially given the industry’s long and cumbersome permitting pipeline. Trump demonstrated how much damage can be caused by a shift in the political winds.

Though it’s impossible to guarantee political stability, Wilson suggested that state and federal regulators could, under a more hospitable future administration, revise the permitting system to at least make it faster and smoother.

After all, European energy developers, who are leaders in offshore wind, were surprised by the fragmented permitting and uncoordinated regulatory landscape they encountered in America, according to Wilson.

This kind of change might address the friction that occurs for projects trying to get approved by multiple governments, which has indeed eroded investor confidence in recent years, according to BNEF’s Sholler.

Klein agreed that coordination between states, counties, and federal agencies could improve, but she also pointed out that the current way of doing things did get results.

“Our permitting process is not broken … We got 11 projects approved,” she said, referencing her time leading the federal branch that regulates offshore wind farms during the Biden administration.

Wilson argues that another “site for learning” would be the Coastal Virginia Offshore Wind project, which, based on its history of strong bipartisan support, could be a “model of success.”

Klein agreed, calling CVOW, “a little bit of a unicorn.”

The project, located nearly 30 miles off the coast of Virginia Beach, Virginia, has the distinction of being America’s largest offshore wind farm and the only one that is getting built by a regulated utility. The project was slated to feed the grid starting this March — and, prior to last month’s federal pause, was progressing on schedule.

Dominion Energy, the utility building the project, operates under a “vertically integrated model,” said Wilson, giving it a long-term stability that is beneficial to slow-moving offshore wind development.

Virginia is also the world’s data-center capital, with tremendous energy demand that offshore wind is especially good at serving, especially in extreme winter conditions. Thanks to CVOW’s careful site placement and community engagement, opposition from fishermen and local groups has been relatively low, according to Captain Bob Crisher, a Virginia-based commercial fisherman.

Still, the project was ultimately not spared the major political obstacle of a Trump administration stop-work order.

Perhaps the biggest lesson, for Wilson at least, is that hyping the offshore wind industry did little good. The target dates and costs estimated were possibly “overhyped,” she said, leading lawmakers and others who turned a blind eye to the reality of offshore wind farms being, ultimately, megaprojects.

Offshore wind is a megaproject sector, and “megaproject dynamics” are well studied in Europe, said Wilson. These social and political processes are predictable, in that costs always go over, timelines typically run long, and environmental impacts are often not well communicated. Over the years, these inevitable outcomes gave influential offshore wind opponents and GOP lawmakers fodder for pushing back on offshore wind.

“This is a useful framework: Megaprojects are hard,” she said.

2025 was, to put it very mildly, an eventful year for the U.S. power sector. The rise of data centers drove soaring electricity demand, debates about energy affordability hit a fever pitch, and the Trump administration went to unprecedented — and legally dubious — lengths to prop up coal and stymie renewables.

Yet despite the excitement, the broader electricity mix looked about the same as ever. Natural gas provided by far the biggest share of the country’s electricity, followed by nuclear, followed by coal, per U.S. Energy Information Administration data released in December.

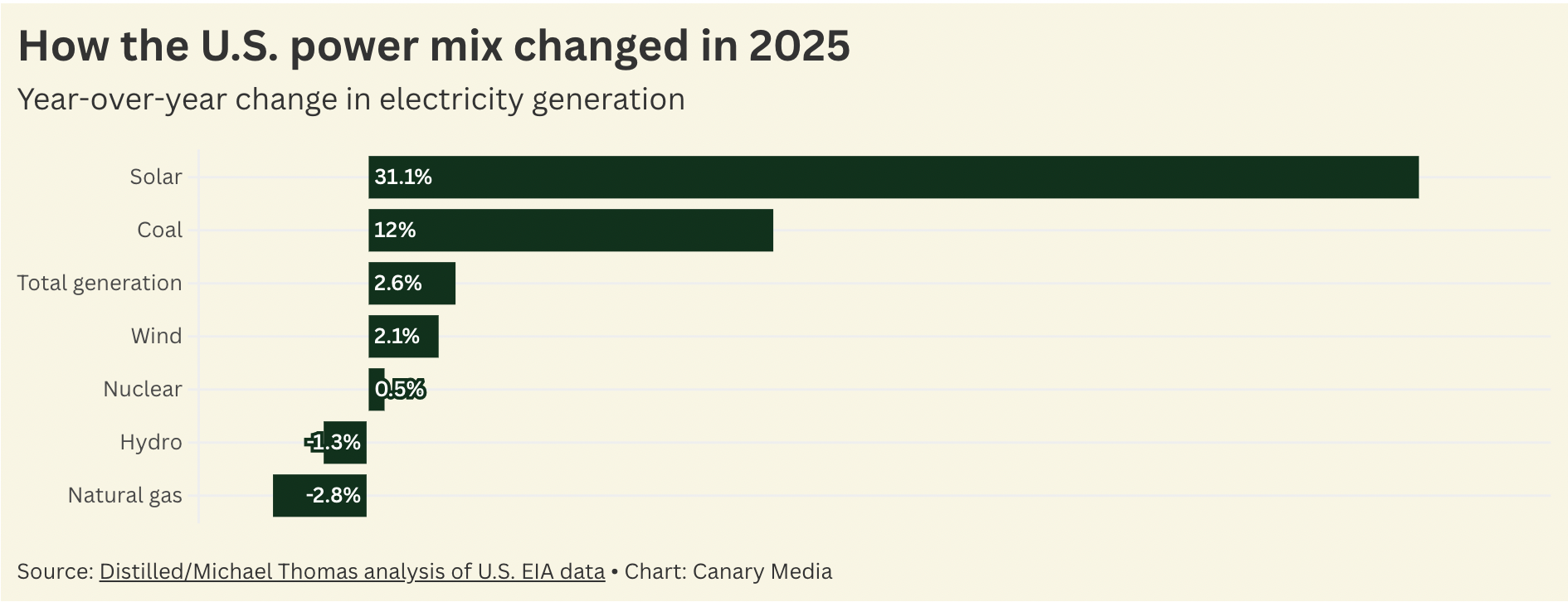

The story gets more interesting, however, when you zoom in. Last year, solar panels produced 31.1% more electricity than in 2024, while coal-fired power plants generated 12% more megawatt-hours, according to EIA data crunched by Michael Thomas at Distilled. Natural gas generation, meanwhile, fell by nearly 3%.

Overall, power demand ticked up by 2.6% — a seismic number for a sector that has been stagnant for over a decade.

Solar’s growth is easy enough to explain: We need more power, and no source of electricity is quicker or cheaper to deploy. The rise of cost-effective battery storage has made solar even more attractive. In fact, despite the considerable roadblocks created by the Trump administration last year, solar and batteries together accounted for more than 80% of new energy capacity added to the grid between last January and November.

The dynamics around coal and gas are a bit wonkier.

Yes, as Thomas points out, President Donald Trump made a show of celebrating “beautiful, clean coal” last year. His administration also used emergency powers to order a number of aging, expensive-to-run coal plants to stay open on the eve of their planned closures. But it’s not as if Trump isn’t also supportive of the U.S.’s natural gas industry. So why the rise for one and the fall for the other?

It boils down to market forces. Gas prices spiked last year, and so did electricity demand. That bolstered the financials for some coal plants, resulting in more coal generation — and, as Thomas points out, a dirtier grid. Power-sector emissions jumped by 4.4% from 2024 to 2025, per Thomas, a significant leap and the second year in a row of rising emissions after years of consistent declines. The EIA expects coal-fired power to shrink this year, however, as more renewables come online and once again erode the economic case for burning the dirty fuel.

And despite coal’s brief resurgence, it wasn’t all positive for the fossil fuel in 2025. In fact, a separate metric may be a better indicator of its long-term outlook: For the second year in a row, wind and solar together produced more U.S. electricity than did coal.

Remember the climate crisis? The relentless, escalating threat to human health and safety that was once the main driver of clean energy policy?

You’d be forgiven if it’s all a bit hazy, given how swiftly the term was dropped from the energy-transition lexicon this year.

Starting on Inauguration Day, President Donald Trump not only eviscerated climate policy but completely upended the way Americans talk about energy. Though Trump seemed more concerned with taking down ideological rivals than helping constituents’ bottom lines, his new lexicon got a boost from consumer concerns about soaring energy prices that had people casting around for quick fixes. Climate change was out. Talk of “energy dominance,” “energy abundance,” and “unleashing American energy” rushed in. The shift was like “6-7” taking over a fourth-grade classroom: inexorable and irresistible.

The new terminology made the scene on Trump’s first day back in the White House, when he signed an executive order with a grab bag of fossil-fuel giveaways under the title “Unleashing American Energy.” A few weeks later, he used another executive order to create the National Energy Dominance Council. Both orders touted the country’s “abundant” resources.

Clean energy advocates quickly began invoking similar terminology in an attempt to shoehorn solar power into the new narrative. The Solar Energy Industries Association even passed out stickers with the phrase “energy dominance” on Capitol Hill as part of its lobbying efforts.

Some media outlets followed suit in deemphasizing climate. In November 2024, five major U.S. newspapers published a total of 524 stories about climate change; in the same month this year, those papers ran just 362 climate change articles, according to researchers at the University of Colorado Boulder — a drop of almost a third. (Both numbers are way down from the October 2021 peak of 1,049 climate articles.)

A number of Democratic politicians embraced the vibe shift in their own ways. “All of the above” crept in among leaders — notably New York Gov. Kathy Hochul and Massachusetts Gov. Maura Healey — who wanted to signal they are open to the changing conversation, but not ready to give up on renewables entirely. In New Jersey and Virginia, Democrats Mikie Sherrill and Abigail Spanberger ran successful gubernatorial campaigns with hardly any mention of climate change; likewise, New York City mayor-elect Zohran Mamdani spent little time on the topic.

Most notably, Democrats this year prioritized the issue of energy affordability, an increasingly urgent concern among voters — and one that Trump is belligerently dismissing.

Two liberal groups, Fossil Free Media and Data for Progress, put out a memo in November that endorses this affordability focus, suggesting it’s a way for Democrats to reconcile the new discourse with the old. The memo encourages them to promote the benefits of renewable energy as a cheap source of power in 2026. The headline: “Don’t run from climate — translate it.”

Though Republicans are failing to reckon with the issue of soaring energy costs, there’s still something seductive about their energy rhetoric. It suggests an economy teeming with possibility, held back only by those meanie Democrats with their snowflakey concerns about climate and their insufficient will to dominate. The language implies there are easy answers to at least some of our woes. Worried about soaring energy bills? Unleash the beautiful coal. Concerned about grid reliability? Exploit those abundant energy supplies. Never mind that fossil fuels are most definitely not the cheapest sources of electricity.

The vocab shift, particularly around “dominance,” also captures a vibe that has always appealed to Trump supporters: “That language does have this bravado and machismo that is important to his movement,” Cara Daggett, a professor of political science at Virginia Tech, told a reporter for Grist earlier this year.

What vocabulary will seize the collective imagination in 2026? Likely, more of the same (though Trump does have a seemingly inexhaustible ability to surprise us all with word choices). The bigger question for me, though, is which version of this new nomenclature will gain the most traction in the months to come. Will the left’s translations catch on, convincing people that clean energy too can be unleashed, abundant, and affordable? Or will the fossil fuel–loving MAGA crowd continue to corner the enticingly muscular language of supremacy?

This year was a big one for Canary Media. Our merger with the Energy News Network brought new reporters into the mix, expanding our focus on state and local clean energy policy and progress.

We sure needed the extra manpower to cover everything that 2025 brought. President Donald Trump shook up the clean energy landscape as soon as he entered the White House, taking particular aim at offshore wind and EVs. Worries about rising power demand from data centers reached a fever pitch. And startups boasted major breakthroughs in cleaning up manufacturing, decarbonizing home heating, and bringing battery storage to the masses.

That’s just a handful of the many, many topics Canary Media reporters covered this year through more than 600 stories. Here are 11 that you can’t miss, in chronological order.

Data centers are overwhelming the grid. Could they help it instead?

Jeff St. John started 2025 with a deep dive into what became one of the year’s hottest energy topics: data centers. In this first installment of a four-part series, Jeff explored the growing concern over AI data centers’ capacity to drive power demand to new heights, and how utilities may use that rising demand to justify new fossil fuel construction. But with effective regulation and demand management, it doesn’t have to be that way.

The smell of toasted rock could spell victory for geothermal energy

Julian Spector turned his visit to Quaise Energy’s Texas testing grounds into a feast for the senses. Whirring contraptions, hand-warming heat, and the smell of toasted marshmallows: Those are just a few of the ways Julian described the experience of watching the startup blast through rock with an electromagnetic beam. It’s all in hopes of accessing deeper, hotter levels of the Earth for geothermal power generation.

The rural N.C. mayor betting big on clean energy to uplift his hometown

Mayor Mondale Robinson has big clean energy dreams for his small rural town of Enfield, North Carolina, and shared them with Elizabeth Ouzts back in March. Residents of the largely Black, devastatingly poor town face massive winter energy bills, and Robinson envisions tackling them through a solar-plus-storage array that could help stabilize power costs — and a resilience hub that could teach residents about energy savings and keep them safe during emergencies.

From EVs to HVAC, clean energy means jobs in Central Illinois

In May, Canary Media joined fellow nonprofit newsrooms to report a series of stories on the growing clean energy workforce in rural America. That project took Kari Lydersen to Decatur, Illinois, which has been losing factory jobs for years. But a community college program is training a new generation of solar panel installers to change that dynamic, including Shawn Honorable, who’s planning to start a solar-powered hot dog stand called Buns on the Run.

US hydropower is at a make-or-break moment

Since the late 1800s, America’s network of hydroelectric dams has provided a steady, clean source of electricity. But their age is catching up with them, Alexander C. Kaufman reported in this deep dive. Nearly 450 dams across the country will need to be relicensed in the next decade, but many must make significant, costly upgrades to keep operating — and may opt to shut down instead.

How Trump gutted the team meant to build America’s energy future

The end of 2025 may also signal the end of the Office of Clean Energy Demonstrations. Created under the Biden administration, the office was meant to be a federally backed launchpad for ambitious but unproven clean technologies. In a thoughtful obituary for OCED, Maria Gallucci recounts the office’s biggest wins, and how that all started crumbling on Day 1 of the Trump administration.

Inside the Colorado factory where AtmosZero is electrifying steam

Cheez Whiz, notepaper, and beer all have one thing in common: They’re made with the help of gas-burning boilers. But if it’s up to AtmosZero, that’ll soon change. Alison F. Takemura took us on a tour of the Colorado factory where AtmosZero will soon start building steam-producing heat pumps, in hopes of decarbonizing all sorts of polluting processes.

Why utility regulators need to do more than call ‘balls and strikes’

Marissa Gillett didn’t make a lot of friends during her time leading Connecticut’s Public Utilities Regulatory Authority. While consumer advocates heralded her assertive oversight, investor-owned utility regulators accused her of inappropriate, and even unlawful, bias. In an interview with Sarah Shemkus after she stepped down from PURA, Gillett didn’t back down from her “sustained, rigorous” approach, and called on other regulators to do the same.

This Ohio county banned wind and solar. Now, residents are pushing back.

Ohio has become a hot spot for anti-clean-energy rules, with more than three dozen counties outlawing utility-scale solar development in at least one of their townships. Richland County is among them, but in the new year, residents may reverse the ban. Kathiann M. Kowalski reports on how a group of local advocates secured a referendum on the decision made by just three county commissioners — and how they could inspire other Ohioans to do the same.

As solar booms and coal fades, Greece’s mining region struggles to adapt

This fall, Dan McCarthy took us on a trip to Greece. Far from Athens and the iconic whitewashed buildings of the Cyclades islands is Western Macedonia, which remains the country’s energy-producing hub even as its coal plants and mines shutter. Solar farms have rapidly taken the fossil fuel’s place, but residents are frustrated that the region’s economy hasn’t kept up.

The man behind the fall of offshore wind

Our list closes with a story Clare Fieseler started following three years ago, at a time when Republican lawmakers didn’t have much to say about offshore wind. Since then, the industry has become a prime target for the Trump administration, and David Stevenson is a big reason why. Stevenson is a 75-year-old grandfather from Delaware who believes in climate change — but not in offshore wind’s ability to fight it. Through numerous conversations with Stevenson, Clare shares the winding tale of how his activism brought the fight against offshore to the highest levels of government.

Think of the Washington Monument. Imagine it sitting on the surface of the sea, with blades as long as a football field slowly spinning. It’s futuristic and white with rounded edges, like a rocketship. But there are no blasts or flares. There is no noise at all but calling gulls.

Sitting on the stern of a shrimp boat in early November, this is what I saw. The captain steered us directly under one of two “pilot” turbines. In the distance, I saw foundations for 176 more, poking a few dozen feet out of the sea. The Hoover Dam came to mind, another landmark feat of energy engineering. Each new turbine will be roughly the same height as the famous dam, from blade tip to the surf below.

“Why do people think they are an eyesore? Doesn’t bother me none,” said the captain, Bob Crisher, a commercial fisherman. He’s in favor of the wind farm and believes it will bring down his electricity bills.

Coastal Virginia Offshore Wind, America’s largest planned offshore wind farm, was then being built about 27 miles east of Virginia Beach. It’s slated to power up to 660,000 homes in a region with the highest concentration of data centers in the world. With energy demand skyrocketing and electricity costs rising, Virginia needs the last construction push on this project to go smoothly. The developer, utility Dominion Energy, promised the turbines would start feeding the grid by March 2026.

How quickly things fell apart.

Last week, the Trump administration ordered a pause on all five in-progress offshore wind projects in America — including Virginia’s — citing unspecified risks to “national security.” It was the largest blow yet to a once-growing industry that Trump has brought to its knees in just 11 months. While Trump spent much of 2025 slowing the incredible rise of renewables, his unrelenting war on so-called “windmills” has been more vicious and personal.

In many ways, Trump’s attacks on offshore wind this year encapsulate this new era of politics. He throttles long-held norms in favor of retribution and personal grievance, acting with dizzying speed. He contorts facts and pushes officials in his administration to do the same.

Left in the wake are everyday citizens — including dozens I’ve interviewed over the past year — who are losing the prospect of good-paying jobs. They and their neighbors are also losing access to public goods like lower emissions, revitalized ports, reliable electricity, and a buffer against skyrocketing power bills driven by an AI boom.

Trump’s grudge against offshore wind began more than a decade ago, when he tried — and failed — to stop 11 turbines from being built within view of one of his Scottish golf courses. He has been disparaging offshore wind turbines as “ugly” and “eyesores” ever since.

He cranked up the intensity when he embarked on his second presidential campaign in 2023, branding big ocean turbines as dangerous. “[W]indmills are causing whales to die in numbers never seen before,” he said that year — a false statement. Still, attacking offshore wind seemed little more than an odd punchline for his campaign rallies. After all, the Trump administration backed the sector for much of his first presidential term, executing multiple offshore wind auctions that had been queued up by the Obama administration.

But Trump’s hyperactive second term has turned fringe movements and personal grudges into full-blown policies. Like his attacks on vaccines and higher education, his blitz on offshore wind farms is having far-reaching implications that will take years to fully enumerate.

Here’s some initial accounting: In-development wind projects have been paused, delayed, and paused again. One fell apart. Two are essentially mothballed after Trump sunsetted wind tax credits. Port revitalizations got cancelled. Developers lost billions. Related manufacturing is drying up. Tens of thousands of once-promised jobs may never be created. Workers already on the job are sitting idle.

One Trump-voting fisherman called the president’s anti-wind campaign “madness.”

But while vaccines and universities will endure through Trump’s political attacks, in one form or another, the U.S. offshore wind industry may not. Despite the ubiquity of offshore turbines in northern Europe and China, there is only one large-scale wind farm fully operational in American waters today. When Trump moved back into the White House, the industry was just taking off.

J. Timmons Roberts, a Brown University professor of environmental studies who tracks opposition to offshore wind, put it simply: “They’re killing the baby while it’s still in the cradle.”

When Trump’s first term ended, there were no federally approved plans for offshore wind farms. When President Joe Biden left office, there were nearly a dozen. All together, there were 40 active leases in various stages of planning, development, and construction in waters along the East Coast from Maine down to the Carolinas, across the Gulf of Mexico, and along the California coast.

But, on the first day of his second term, Trump signed an executive order that froze offshore wind permitting, blocking proposed projects that didn’t already have federal approval. And he ordered a new review of the projects that did have federal permits but were not yet fully completed, throwing their future into doubt. (The executive order was ultimately struck down by a federal court on December 9.)

Unease amongst state leaders, developers, and investors immediately took root.

Within days, the first permitted project began to fall apart due to “uncertainty” over federal actions. In late January, Shell — one of two developers of the Atlantic Shores wind farm slated to be built east of New Jersey — announced it was withdrawing from the project. New Jersey then abandoned plans to purchase power from the installation. The final blow came weeks later when Trump’s Environmental Protection Agency revoked a Clean Air Act permit for the project. One former EPA official called the move “unusual.”

Research cuts and funding clawbacks soon followed.

In May, Lincoln Varnum was called into his supervisor’s office at the University of Maine, where he worked as an instrumentation engineer. Varnum was one of nine employees laid off from the university’s high-profile engineering and offshore-wind research center due to the Trump administration pausing funding. The administration also cancelled federal funding for Maine’s first floating offshore wind array, which had been fully permitted; the project was then mothballed.

“I obviously got a little emotional in the meeting … Something that I cared about was getting terminated,” Varnum told me. “It was also the first time I had ever been laid off.”

He sees himself and others who’ve been working on offshore wind as collateral damage.

In the following weeks, Varnum, who once identified as a conservative, was hopeful that Republican members of Congress would speak up about the funding cuts, but none of them did — not even Maine’s Sen. Susan Collins, a long-time offshore-wind supporter. He described Collins’ silence as “rough,” especially since he had voted for Collins in the past.

“We’re a poor state. We need industry. To have a new industry that is unique to us, floating offshore wind, now targeted by the feds … It feels like a kick in the teeth,” said Varnum.

Trump yanked funding in other ways.

In September, the Department of Transportation pulled back $679 million for infrastructure projects that supported offshore wind, including one that would have cleaned up and revitalized a massive California port. Mandy Davis, a California resident and anti-wind activist, aligns herself with Trump’s false narrative that turbines harm the ocean environment. She was elated by cuts that might block turbine construction in California’s waters, but her joy was short-lived.

In November, when the Trump administration announced plans for new oil drilling off the California coast, she told me it was a “betrayal.”

New England communities, which spent over a decade preparing to build America’s first offshore wind farms, also felt betrayed. Prior to Trump’s December halt, two massive projects had been paused by the Interior Department earlier in the year. One of the projects, Revolution Wind off the coast of Rhode Island, was already 80 percent completed.

“It’s like having the rug pulled out from under you,” Jack Morris, a Massachusetts-based scalloper and Trump voter, told me earlier this year. “Nobody understands why Trump did it. I don’t know what Trump’s agenda is.”

Revolution Wind had employed 80 local fishermen, including Morris, to help with construction. The project’s pause caused Morris and others to lose some of the part-time income that helps them pay their bills as fishing revenues dry up.

The stop-work orders for Revolution Wind and New York’s Empire Wind were each lifted or reversed after about a month. But some damage was permanent. According to Harrison Sholler, an energy analyst for BloombergNEF, the orders were a signal to companies that America is not a sound investment. Foreign firms had invested heavily in the sector, lost billions, and are now looking for the door.

Trump’s more sweeping wind halt last week only reinforced that assessment.

“What exactly will America have lost? How do you even begin to answer that question?” pondered Elizabeth Wilson, a professor of environmental studies at Dartmouth College.

We could start by looking at how much new electricity capacity won’t be added to America’s increasingly strained grid.

Before Trump was elected last November, BNEF expected 39 gigawatts of offshore wind to be built in the U.S. by 2035. BNEF’s latest forecast is for just 6 gigawatts by 2035 — and even that number could come down thanks to Trump’s latest pause.

Another lens is employment. Together, the five wind farms currently underway have been slated to generate about 10,000 jobs. Now some of the highly skilled workers who have already trained for those projects face an uncertain future. And the 77,000 offshore wind jobs that the Biden administration had projected the country would see in the coming decades may never materialize.

Varnum, the laid-off engineer, said that if Maine’s nascent offshore wind industry rises from the ashes sometime in the future, he “certainly would want to help. It’s not something I’m turning my back on.”

He has since found a job working for a hydroelectric company. But Varnum said he fears for America’s energy future and how far Trump might take his broader war on carbon-free energy. The president has already boosted fossil-fuel production and nuclear power while trying to tamp down clean energy. His political revenge against offshore wind may be paving the way for more.

“The guy torpedoes us on Day One and how far is he going to go? How far will this go?” wonders Varnum.

Wilson of Dartmouth says that Trump’s assault on offshore wind is ultimately a battle over facts and truth.

Fossil fuel–backed activists and groups have for years been spreading misinformation about wind turbines harming whales. They lit the match and Trump fanned the flames. The president ranted and made false claims about offshore wind throughout 2025, in front of reporters, foreign heads of state, and the entire United Nations General Assembly

Meanwhile, his administration quietly axed over $5 million for research into the impact of offshore wind on the giant mammals, ending the best and longest-running studies on the issue, as Canary Media first reported.

Interior Secretary Doug Burgum justified the Trump administration’s pause of the Empire Wind project by claiming the Biden administration approved it based on “flawed & bad science” about impacts on marine life, but the Interior Department refused to share the report that supposedly backed that up. The project’s developer and Democrats in Congress are still waiting for an unredacted version.

“There’s no proof, right? There are no receipts,” Sen. Martin Heinrich, Democrat of New Mexico, told me in June. He said the administration hid the report and then used the permitting process as a “political tool,” something he sees as typical of “a banana republic.”

Without new offshore turbines going up, millions of households across the Northeast will soon pay more money for dirtier and less reliable electricity. According to a recent report, offshore wind power could help keep the lights on year-round in the Northeast and mid-Atlantic regions, especially during harsh winter weather when gas plants can fail. Cuts to planet-warming pollution, mandated by several East Coast states, are also now out of reach. All signs point to Trump’s second term creating a hotter and less affordable future for Americans.

Few people interviewed for this story expressed hope that the damage from Trump’s war on “windmills” could be reversed anytime soon.

“What Trump really killed was hope,” said Wilson. “And what is the value of hope?”

Two corrections were made on January 5, 2026: This article originally implied that Maine had more than one Republican member of Congress. In fact, it has only one: Sen. Susan Collins. The article also originally misstated the number of offshore wind leases in planning or development at the end of the Biden administration. The number was 40.

We’re proud of the 650+ clean energy stories our small team brought you last year. We’re so proud we even made a reading list of our favorite articles.

But this is a different type of list. It’s about the stories we didn’t write but wish we had — sharp pieces from rival outlets big and small that uncovered new information, reframed the debate, or were simply fun to read.

Here are some of the stories from last year we wish we could claim as our own. (In a moment of meta-jealousy, it bears mentioning that the idea for a “jealousy list” is borrowed from Bloomberg Businessweek, which has been publishing annual versions since 2015.)

Rooftop solar is a miracle. Why are we killing it with red tape?Mother Jones

Why don’t we have solar panels on every rooftop? Bill McKibben’s story in Mother Jones exposes the stark contrast between installing home solar in the U.S., a process mired in red tape, and doing so in Australia, Spain, Germany, and other countries where it’s so much cheaper and easier. This feisty piece makes you want to slap your forehead and ask, “Why can’t we have nice things, too?” — Alison F. Takemura, reporter

When the blade breaksThe Verge

Nantucket native and novelist Gabriella Burnham wrote for The Verge about the fallout from a 2024 incident in which a turbine blade broke off a New England offshore wind project. With rich detail and narrative momentum, Burnham’s reporting reveals how wealth and island dynamics became a perfect storm for renewables pushback. Nowhere else will you read about local dudes making T-shirts that read “Vineyard Wind is ISIS,” and no one but a local writer like Burnham could have written a piece like this. — Clare Fieseler, reporter

Trump’s quest for ‘energy dominance’ is all about the vibesGrist

President Donald Trump has pulled a total Gretchen Wieners from “Mean Girls” this past year: Just like she wanted to make fetch happen, he’s trying his darnedest to make the term “American energy dominance” stick. But what does it actually mean? Grist’s ever-thoughtful Kate Yoder has answers in a story I wish I had written that draws on experts, history, and smart analysis. — Ysabelle Kempe, associate editor

How a Koch-funded campaign is trying to reverse climate action in VermontVTDigger

Apparently I let this one linger a little too long on my to-do list, because VTDigger’s Austyn Gaffney beat me to it — and, with her in-depth knowledge of Vermont politics, did a better job than I could have. It’s a fascinating, rigorously reported, and kind of frightening look into how the Koch brothers’ Americans for Prosperity is setting up shop in one of the country’s bluest states, making inroads with its brand of clean-energy and climate disinformation. — Sarah Shemkus, reporter

Why did Hochul back down on New York’s gas ban?New York Focus

Democratic New York Gov. Kathy Hochul’s decision to suspend the state’s first-in-the-nation all-electric buildings law had every climate-conscious New Yorker shaking their head and asking “Why?” Colin Kinniburgh of New York Focus provided an answer, albeit not a very satisfying one for anyone who cares about cleaner buildings and a healthier planet. Regardless of how you feel about the state’s constant climate backtracking, it’s a great example of journalism that breaks down the legalese so you don’t have to. — Kathryn Krawczyk, engagement editor

The airline industry’s dirty secret: Clean jet fuel failuresReuters

For journalists, there’s always a push and pull between covering news as it happens and stepping back to make sense of the headlines. This Reuters investigation on “sustainable aviation fuels” does an excellent job at the latter, with a data-driven, multimedia approach. The feature reveals that, behind all the promise of progress, airlines and energy companies are falling far behind on efforts to bring low-carbon jet fuel to the skies. — Maria Gallucci, senior reporter

Is data center flexibility a ‘regulatory fiction’?Latitude Media

Everyone’s talking about data center “flexibility” as the solution to the cost pressures the AI boom is putting on everyday utility customers. But what does “flexibility” mean — and is it allowed? In this quick-turnaround story, Maeve Allsup does an extraordinary job condensing the highly wonky conflicts between grid experts seeking to make data center flexibility a reality in the most data center–impacted U.S. power market. — Jeff St. John, chief reporter and policy specialist

River rafting in Colorado offers climate lessons for Southern CaliforniaLos Angeles Times

Sammy Roth excels at grounding big climate and energy debates in the parched dirt of the Western landscape. As a reporter and commentator for the L.A. Times, he held California leaders accountable when their actions on climate didn’t match their rhetoric. I’m especially partial to (and envious of) his dispatches from far-flung corners of the West, like this one in which a rafting trip in the high mountains of Colorado reveals unexpected linkages from wilderness river guides to inner-city L.A. renters. We’re lucky Sammy kept the whitewater off his notebook, and now he continues the chronicle at his new Substack, Climate Colored Goggles. — Julian Spector, senior reporter

The quick and shameful death of Biden’s biggest policyThe New Republic

Kate Aronoff gives the death of the Inflation Reduction Act the deep treatment it deserves. Her story is sweeping and nuanced, and explains not only the rise and fall of the now-gutted climate law, but also sketches out where climate politics might go from here. If you want to read one thing to better understand where U.S. climate policy stands as we enter 2026, it should be this. — Dan McCarthy, senior editor

Why the time has finally come for geothermal energyThe New Yorker

I’ve covered the rise of geothermal energy in recent years and, in 2024, I was lucky enough to visit Iceland to learn more firsthand. So I was especially jealous to see this beautifully written dispatch by Rivka Galchen about her own tour of the Nordic country. It’s filled with lush details about the landscape, people, and even tiny horses, and it’s a vivid account of how geothermal has developed over centuries — and could help meet the energy and climate challenges we’re facing today. — Maria Gallucci, senior reporter

The obscure philosophical battle that could reshape the clean energy economyHeatmap

If you’re an energy-policy nerd like me, you’ve probably seen he-said, she-said coverage of the battle playing out over renewable energy certificates, and perhaps you’ve asked yourself why we can’t find a win-win solution to the problem of properly accounting for the carbon impacts of clean energy purchases by tech and corporate giants. This story from Emily Pontecorvo does an excellent job of explaining what’s at stake and why it has been so hard to find consensus. — Jeff St. John, chief reporter and policy specialist

The backlash to high electric bills could transform U.S. politicsTIME

As an editor, I’m perpetually preoccupied with how to make wonky topics accessible to non–energy nerds. Rising power costs is one such topic — and the public is sitting up and paying attention to it. This TIME article by Justin Worland was published in the lead-up to the November election for two seats on Georgia’s Public Service Commission, but it remains relevant as an easy-to-grasp primer on things like data center growth, utility regulation, and surging electricity demand. Plus, it tees up all of the issues everyone will be talking about even more this coming year as the 2026 midterms approach. — Wendy Becktold, managing editor

Liberal Oregon and Washington vowed to pioneer green energy. Almost every other state is beating them.Oregon Public Radio/ProPublica

State leadership on clean energy has become all the more vital since the federal government launched an all-out war on renewables. This investigation, by Oregon Public Radio and ProPublica, shows why Oregon and Washington have struggled to build many clean energy projects in spite of passing some of the most ambitious climate laws in the country. Surprisingly, the evidence points to a nonprofit public power agency from the New Deal era holding things up. — Julian Spector, senior reporter

The Interior Department announced Monday it is pausing leases for all five large-scale offshore wind projects under construction in America, citing unspecified issues of national security.

Canary Media obtained a copy of a letter notifying one of the affected wind farm developers, providing new details about the move — the Trump administration’s most sweeping attempt yet to halt offshore wind construction.

A Bureau of Ocean Energy Management letter to Dominion Energy executive Joshua Bennett orders the Virginia-based utility to “suspend all ongoing activities” related to its Coastal Virginia Offshore Wind project, a 2.6-gigawatt wind farm slated to start coming online in less than four months, for “the next 90 days for reasons of national security.”

“Based on BOEM’s initial review of this classified information, the particularized harm posed by this project can only be feasibly averted by suspension of on-lease activities,” the letter reads.

The 90-day time frame is not mentioned in the Interior Department’s official statement on the order.

The letter adds that BOEM will work “in coordination with [the Department of War]” during the suspension to determine whether the risk posed by the Coastal Virginia Offshore Wind project can be mitigated. It also states that “BOEM will consider all feasible mitigation measures before making a decision as to whether the project must be cancelled.”

Ultimately, “BOEM may further extend the 90-day suspension period” based on its review of each project, according to the letter.

News of the pause was first reported by Fox News. Wind developers didn’t receive stop-work orders via letters from BOEM until roughly an hour or two later, according to a person familiar with the matter who was granted anonymity because they are not authorized to comment publicly.

The letter obtained by Canary Media mentions an “assessment” completed by the “Department of War” in November that contains “new classified information, including the rapid evolution of relevant adversary technologies and the resulting direct impacts to national security from offshore wind projects. These impacts are heightened by the projects’ sensitive location on the East Coast and the potential to cause serious, immediate, and irreparable harm to our great nation.”

There is currently one large-scale offshore wind installation operating in the U.S. — the South Fork Wind farm off the coast of New York — as well as two pilot-scale projects generating electricity near Block Island, Rhode Island, and Virginia Beach, Virginia. The letter makes no mention of these East Coast projects or any national security risks their operation may pose.

The letter was signed by Matthew Giacona, the acting director of BOEM, a young political appointee and former oil and gas lobbyist for the National Ocean Industries Association.

In October, congressional Democrats asked the Interior Department’s inspector general to investigate Giacona following revelations, first reported by the news site Public Domain, that he has used his BOEM position to work on niche policy matters previously the focus of his oil lobbying role.

The Interior Department’s press release about the pause also cites claims not included in the letter to Dominion Energy, including mention of a 2024 Department of Energy study that determined offshore wind turbines could cause radar to “miss actual targets” while also noting that “wind energy will play a leading role in the nation’s transition to a clean energy economy.”

Dominion Energy did not respond to a request for comment.

A spokesperson for Equinor, the partially state-owned Norwegian energy firm that is developing the Empire Wind project off the coast of New York, said, “We are evaluating the order and seeking further information from the federal government.”

The Trump administration had previously hit two of the affected projects — Empire Wind and Revolution Wind — with stop-work orders. Both installations were later allowed to proceed, although that construction pause cost Equinor nearly $1 billion. The remaining three projects, Coastal Virginia, Vineyard Wind, and Sunrise Wind, had been spared until now. Several of these projects are more than halfway complete; Revolution Wind is at least 80% finished.

Monday’s announcement is not the first time the administration has used national security as an excuse for throwing sand in the gears of offshore wind.

Upon pausing the Revolution Wind project in August, Interior Secretary Doug Burgum invoked national security concerns, including the threat posed by “undersea drones.”

But between 2020 and 2023, the Revolution Wind project endured an extensive regulatory review, including by the Pentagon and Federal Aviation Administration. BOEM approved the project under the condition that all turbines be built to lighting and marking standards that would ensure they’re visible to aircraft at night. Radar mitigation requirements were mentioned in the approval, demonstrating stakeholder engagement on this issue. In August 2023, the U.S. Army Corps of Engineers — a branch of the military — co-signed the authorization of plans for Danish developer Ørsted to build 65 wind turbines for the Revolution Wind project.

“Was the military at the table, represented and consulted with during this stakeholder process? The answer is: very much so,” wind energy veteran Bill White told Canary Media in August. From 2009 to 2015, White represented Massachusetts on a BOEM-led intergovernmental task force focused on the siting of New England offshore wind energy areas.

In February 2024, a Brown University research group examined 441 claims made against offshore wind during the first six months of 2023. They found multiple times “military readiness” and “radar interference” were mentioned in ways that the researchers found misleading or problematic.

“[S]uggesting that our military is unaware of this issue or has done nothing to address it is completely untrue,” the report concluded.

J. Timmons Roberts, a co-author of the report and a professor of environmental studies and sociology at Brown University, called the administration’s halt to five approved wind farms because of classified national security information “bonkers.”

“These claims aren’t new and they have been, in the past, shown to be quite baseless,” he said.

A correction was made on December 23, 2025: This story originally stated that Giacona had yet to receive Senate confirmation, but his position does not require such approval. It has also been updated to clarify the terms of Revolution Wind’s approval, which included radar mitigation requirements

Kansas ranks among the sunniest states in the nation, and its famously flat landscape is ideal for vast rows of solar panels. Yet it ranks just 41st for solar installations, raising the question: What’s the matter with Kansas?

The simple answer is that on the gusty Great Plains, wind energy gained an early foothold and dominated the renewable buildout. The wonkier explanation points to the state’s weak incentives — including a voluntary renewable energy portfolio standard and a limited net-metering rule — as well as pushback from residents who don’t want to live next to solar arrays. As a result, the state has few utility-scale solar installations.

The developer of a 270-megawatt project in the northwestern corner of Kansas thinks the Sunflower State’s solar industry is poised to bloom.

Last week, Doral Renewables announced a power-purchase agreement for its Lambs Draw Solar project in rural Decatur County, bordering Nebraska. The company declined to disclose its offtaker, but CEO Nick Cohen said, “It’s a major tech company with a big name that does a lot of data centers across the U.S.”

“This is a turning point,” Cohen said. “You’re going to see more and more solar in places like Kansas.”

As recently as five years ago, he said, “it would have been wind.” But the best tracts of land for building turbines have already been developed.

The data indicates that a solar boom is indeed getting underway in Kansas — one in which Lambs Draw will be a key participant but far from the only one. In May, the state plugged in its first major project in the 189 MW Pixley Solar Energy installation, a big leap from the state’s second-biggest array of just 20 MW. Several even larger projects are expected to come online over the next few years, including a sprawling 510 MW installation slated to go live next December.

Construction hasn’t yet begun on Lambs Draw, but Cohen said the site is “shovel ready” and expects the project to benefit from safe-harbor rules that allow developers to lock in expiring federal investment tax credits by breaking ground early next year.

“What has happened is that solar has become the lowest levelized cost of energy of any new-build energy source out there,” Cohen said. “Solar has reached the tipping point where it’s the most economical and achievable energy solution in places like Kansas.”

Lambs Draw will span 4,000 acres leased from four landowners, though not all of it will host panels. Part of Doral Renewables’ strategy is to “use avoidance and what I call neighborly courtesy,” Cohen said. That means “getting more land than we need, then avoiding any sort of environmental features, whether it’s a habitat or wetlands.”

Then, he said, “we’ll ask neighbors, ‘Is it OK if we put this here?’”

The local acceptance matters. At this point, solar development is “not really a question of state by state anymore,” said Pol Lezcano, the director of energy and renewables research at the real estate and consulting firm CBRE.

“It’s more like a county-by-county issue,” he said.

The economic development agency in Decatur County lured Doral to the region in hopes of generating more tax income and finding a way for farmers to diversify revenue.

“They respect landowner rights as sacred,” Cohen said. “The officials in the county are also very professional and see this as a generational uplift for everyone. They’ve been incredibly friendly. They convinced us to come, and it worked.”

Part of Doral’s appeal was that Lambs Draw may, in fact, involve lambs. The company plans to incorporate agrivoltaics, with crops planted between rows of panels and livestock employed to graze and keep the grasses trimmed. Cohen said the company and its landlords haven’t yet decided what to plant.

Despite the acreage, Lambs Draw’s 270 MW is smaller than the Philadelphia-based Doral’s typical 500 MW project. The size, Cohen said, is limited by what the local power lines — which connect to the Southwest Power Pool grid system — can handle.

“Originally, we wanted it to be more, but ultimately the grid is a constraint,” he said. “It’s healthy at 270, and that’s where we’re going to keep it.”

Nationwide, Doral has 400 MW of solar in operation, another gigawatt under construction, and more than 15 GW in the queue.

The company hasn’t yet selected the panels for Lambs Draw. But its 1.3 GW Mammoth Solar project currently underway in Indiana uses panels from manufacturers in Texas and India. Doral expects to make a similar deal for Lambs Draw, allowing the company to obtain panels quickly enough to access sunsetting federal tax credits and avoid new restrictions on imports from China.

“Solar is a once-in-a-lifetime opportunity for rural America, and places like northwestern Kansas have an opportunity to have a competitive advantage,” Cohen said. “They have something other people don’t have: flat, tillable farm fields with a strong grid connection.”

This story was originally published by Grist. Sign up for Grist’s weekly newsletter here.

President Donald Trump spent most of 2025 hacking away at large parts of the federal government. His administration fired, bought out, or otherwise ousted hundreds of thousands of federal employees. Entire agencies were gutted. By so many metrics, this year in politics has been defined more by what has been cut away than by what’s been added on.

One tiny corner of regulation, however, has actually grown under Trump: the critical minerals list. Most people likely hadn’t heard of “critical minerals” until early this year when the president repeatedly inserted the phrase into his statements, turning the once obscure policy realm into a household phrase. In November, the U.S. Geological Survey quietly expanded the list from 50 to 60 items, adding copper, silver, uranium, and even metallurgical coal to the list. In mid-December, South Korean metal processor Korea Zinc announced that the federal government is investing in a new $7.4 billion zinc refinery in Tennessee, in which the Department of Defense will hold a stake.

But what even is a critical mineral?

The concept dates back to the first half of the 20th century, especially World War II, when Congress passed legislation aimed at stockpiling materials vital to the United States’ well-being. President Trump established the critical minerals list in 2018, with the defining criteria being that any mineral included be “essential to the economic and national security of the United States” and have a supply chain that is “vulnerable to disruption.” A mineral’s presence on the list can convey a slew of benefits to anyone trying to extract or produce that mineral in the U.S., including faster permitting for extraction, tax incentives, or federal funding.

As Grist explored in its recent mining issue, critical minerals are shaping everything from geopolitics to water supplies, oceans, and recycling systems. If there is to be a true clean energy transition, these elements are key to it. Metals such as lithium, cobalt, and nickel form the backbone of the batteries that power electric vehicles. Silicon is the primary component of solar cells, and rare earth magnets help wind turbines function. Not to mention computers, microchips, and the multitude of other things that depend on critical minerals.

Currently, the vast majority of critical minerals used in the United States come from China — some 80%. In his first term, Trump tried to increase domestic production of these minerals. “The United States must not remain reliant on foreign competitors like Russia and China for the critical minerals needed to keep our economy strong and our country safe,” he said in 2017. Securing a domestic supply was also a cornerstone of former President Joe Biden’s landmark climate bills, the bipartisan infrastructure law and the Inflation Reduction Act.

Now, as Trump has taken office again, he’s made critical minerals an ever more central part of his policy platform. We’re here to demystify why this has been a blockbuster year for critical minerals in the United States — and where the industry may go in the future.

In March, Trump issued an executive order meant to jump-start critical mineral production. “It is imperative for our national security that the United States take immediate action to facilitate domestic mineral production to the maximum possible extent,” he said. The executive order was just the first step in a coordinated effort by the Trump administration to strengthen U.S. control over existing supply chains for copper, lithium, cobalt, manganese, nickel, and dozens of other critical minerals and to galvanize new mines, regardless of concerns raised by Indigenous peoples. The Trump administration has sought to accomplish these goals by both reducing the regulatory barriers to production and by investing in the companies poised to do it.

Since then, Trump has signed agreements with multiple countries to increase investments in critical minerals and strengthen supply chains. Most recently, the U.S. made a deal with the Democratic Republic of Congo, which holds more than 70% of the world’s cobalt. He has pushed federal agencies to make it easier for mining companies to apply for federal funding, and is inviting companies to apply to pursue seabed mining in the deep waters around American Samoa, near Guam and the Northern Marianas, around the Cook Islands, and in international waters south of Hawaii — prompting global outrage and opposition from Native Hawaiian, Samoan, and Chamorro/CHamoru peoples. At the same time, Trump’s volatile tariff policies have made it harder for American companies to source minerals, and cuts to federal funding have harmed mining workforce training programs and research into critical minerals.

While the Biden administration provided grants and loans to various mining companies, Trump is deploying a highly unusual strategy of buying stakes in private companies, tying the financial interests of the U.S. government with the interests and success of these commercial mining operations. Over the past few months, the Trump administration has spent more than a billion dollars in public money to buy minority stakes in private companies like MP Materials, ReElement Technologies, and Vulcan Elements. In Alaska, that strategy has involved investing more than $35 million in Trilogy Metals to buy a 10% stake in the company, which is a major backer of a copper and cobalt mining project in Alaska.

In September, the Trump administration finalized another deal with the Canadian company Lithium Americas behind Thacker Pass in Nevada, which is expected to be the largest lithium mine in the U.S. The Biden administration approved a $2.23 billion loan to Lithium Americas in October 2024; the Trump administration then restructured the loan and obtained a 5% stake in the project and another 5% stake in Lithium Americas itself. (A top Interior Department official has since been reported to have benefited financially from the project.) That’s despite allegations that the mine violates the rights of neighboring tribal nations and is proceeding without their consent, which Lithium Americas has denied.

Historically, the federal government has only taken equity stakes in struggling companies, such as through the Troubled Asset Relief Program that sought to stabilize the auto industry and U.S. banks during the 2008 financial crisis. “What we’re talking about here is something very different, which is an industry that has not yet launched,” said Beia Spiller, who leads critical minerals work at the nonprofit research group Resources for the Future.

“Whether that’s going to work, I think is unlikely,” Spiller continued. “The best way to get an industry up and running is to have policies that raise the tide for everyone, not just choosing winners.”

In reference to Lithium Americas, Spiller said, “If you actually look at the cost fundamentals, it’s not a very competitive company.” Lithium Americas mines metal from clay, an old process that requires a lot of land, open pit mines, and heavy machinery — whereas some newer operations use direct lithium extraction, which is more cost-effective in the long term. “So we just took an equity stake in a company that is going to face headwinds in terms of costs — now the American public faces that downside.”

It must also be stressed that the Trump administration’s rapid push to shore up the U.S.’s control over critical minerals isn’t about transitioning the country away from fossil fuels. Instead, the whole effort seems to mostly be geared toward military uses. Trump’s One Big Beautiful Bill Act allocated $7.5 billion for critical minerals, $2 billion of which will go directly to the national defense stockpile. Another $5 billion was allocated for the Department of Defense to invest in critical mineral supply chains.

In October, a former official at the Defense Department told the Financial Times that the agency is “incredibly focused on the stockpile.”

“They’re definitely looking for more, and they’re doing it in a deliberate and expansive way, and looking for new sources of different ores needed for defense products,” the unnamed official said.

The administration recently announced that it plans to take equity stakes in more mining companies next year. It’s possible, Spiller said, these investments could extend to outfits that are piloting deep-sea mining. That carries a new set of risks, as many banks refuse to insure deep-sea mining operations, it’s unclear whether seabed mining operations will be able to even get off the ground before the end of Trump’s term, and the legal repercussions associated with undermining the Law of the Sea could fracture the stability among global powers — and make global climate action that much harder.