Powering Rural Futures: Clean energy is creating new jobs in rural America, generating opportunities for people who install solar panels, build wind turbines, weatherize homes, and more. This five-part series from the Rural News Network explores how industry, state governments, and education systems are training this growing workforce.

DECATUR, ILLINOIS — A fistfight at a high school football game nearly defined Shawn Honorable’s life.

It was 1999 when he and a group of teen boys were expelled and faced criminal charges over the incident. The story of the “Decatur Seven” drew national headlines and protests led by the Rev. Jesse Jackson, who framed their harsh treatment as blatant racism. The governor eventually intervened, and the students were allowed to attend alternative schools.

Honorable, now 41, was encouraged by support “from around the world,” but he said the incident was traumatizing and he continued to struggle academically and socially. Over the years, he dabbled in illegal activity and was incarcerated, most recently after a 2017 conviction for accepting a large amount of marijuana sent through the mail.

Today, Honorable is ready to start a new chapter, having graduated with honors last week from a clean energy workforce training program at Richland Community College, located in the Central Illinois city of Decatur. He would eventually like to own or manage a solar company, but he has more immediate plans to start a solar-powered mobile hot dog stand. He’s already chosen the name: Buns on the Run.

“By me going back to school and doing this, it shows my nephews and my little cousins and nieces that it is good to have education,” Honorable said. “I know this is going to be the new way of life with solar panels. So I’ll have a step up on everyone. When it comes, I will already be aware of what’s going on with this clean energy thing.”

After decades of layoffs and factory closings, the community of Decatur is also looking to clean energy as a potential springboard.

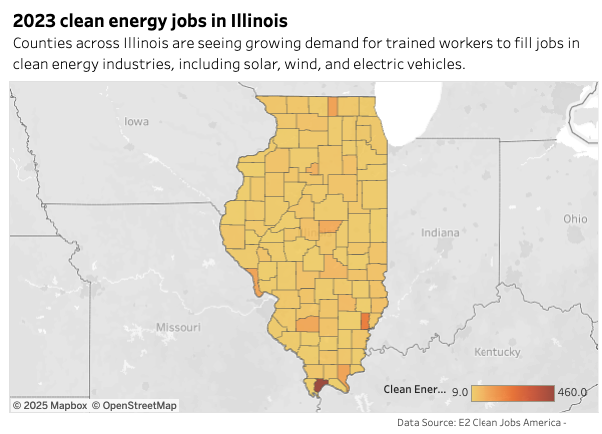

Located amid soybean fields a three-hour drive from Chicago, the city was long known for its Caterpillar, Firestone Tire, and massive corn-syrup factories. Industrial jobs have been in decline for decades, though, and high rates of gun violence, child poverty, unemployment, and incarceration were among the reasons the city was named a clean energy workforce hub funded under Illinois’ 2021 Climate and Equitable Jobs Act (CEJA).

Decatur’s hub, based at Richland Community College, is arguably the most developed and successful of the dozen or so established statewide. That’s thanks in part to TCCI Manufacturing, a local, family-owned factory that makes electric vehicle compressors. TCCI is expanding its operations with a state-of-the-art testing facility and an on-site campus where Richland students will take classes adjacent to the manufacturing floor. The electric truck company Rivian also has a factory 50 miles away.

“The pieces are all coming together,” Kara Demirjian, senior vice president of TCCI Manufacturing, said by email. “What makes this region unique is that it’s not just about one company or one product line. It’s about building an entire clean energy ecosystem. The future of EV manufacturing leadership won’t just be on the coasts — it’s being built right here in the Midwest.”

The Decatur CEJA program has also flourished because it was grafted onto a preexisting initiative, EnRich, that helps formerly incarcerated or otherwise disenfranchised people gain new skills and employment. The program is overseen by the Rev. Courtney Carson, a childhood friend of Honorable and another member of the Decatur Seven.

“So many of us suffer significantly from our unmet needs, our unhealed traumas,” said Carson, who was jailed as a young man for gun possession and later drag racing. With the help of mentors including Rev. Jackson and a college basketball coach, he parlayed his past into leadership, becoming associate pastor at a renowned church, leading a highway construction class at Richland, and in 2017 being elected to the same school board that had expelled him.

Carson, now vice president of external relations at the community college, tapped his own experience to shape EnRich as a trauma-informed approach, with wraparound services to help students overcome barriers — from lack of childcare to PTSD to a criminal record. Carson has faith that students can overcome such challenges to build more promising futures, like Decatur itself has done.

“We have all these new opportunities coming in, and there’s a lot of excitement in the city,” Carson said. “That’s magnificent. So what has to happen is these individuals who suffered from closures, they have to be reminded that there is hope.”

Richland Community College’s clean energy jobs training starts with an eight-week life skills course that has long been central to the larger EnRich program. The course uses a Circle of Courage practice inspired by Indigenous communities and helps students prepare to handle stressful workplace situations like being disrespected or even called a racial slur.

“Being called the N-word, couldn’t that make you want to fight somebody? But now you lose your job,” said Carson. “We really dive deep into what’s motivating their attitude and those traumas that have significantly impacted their body to make them respond to situations either the right way or the wrong way.”

The training addresses other dynamics that might be unfamiliar to some students — for example, some male students might not be prepared to be supervised by a woman, Carson noted, or others might not be comfortable with LGBTQ+ coworkers.

Life skills are followed by a construction math course crucial to many clean energy and other trades jobs. During a recent class, 24-year-old Brylan Hodges joked with the teacher while converting fractions to decimals and percentages on the whiteboard. He explained that he moved from St. Louis to Decatur in search of opportunity, and he hopes to become a property manager overseeing solar panel installation and energy-efficiency upgrades on buildings.

Students take an eight-hour primer in clean energy fields including electric vehicles, solar, HVAC, and home energy auditing. Then they choose a clean energy track to pursue, leading to professional certifications as well as a chance to continue at Richland for an associate degree. Under the state-funded program, students are paid for their time attending classes.

Marcus James was part of the first cohort to start the program last October, just days after his release from prison.

He was an 18-year-old living in Memphis, Tennessee, when someone shot at him, as he describes it, and he fired back, with fatal consequences. He was convicted of murder and spent 12 years behind bars. After his release he made his way to Decatur, looking for a safer place to raise his kids. Adjusting to life on the outside wasn’t easy, and he ended up back in prison for a year and a half on DUI and drug possession charges.

Following his release, he was determined to turn his life around.

“After I brought my kids up here, I end up going back to prison. But at that moment, I realized, man, I had to change,” James told a crowd at an event celebrating the clean jobs program in March.

James said that at first, he showed up late to every class. But soon the lessons sank in, and he was never late again. He always paid attention when people talked, and he gained new confidence.

“As long as I put my mind to it, I can do it,” said James, who would like to work as a home energy auditor. Richland partners with the energy utility Ameren to place trainees in such positions.

“I like being out in the field, learning new stuff, dealing with homes, helping people,” James said, noting he made energy-efficiency improvements to his own home after the course.

Illinois’ 2017 Future Energy Jobs Act (FEJA) launched the state’s clean energy transition, baking in equity goals that prioritize opportunities for people who benefited least and were harmed most by the fossil fuel economy. It created programs to deploy solar arrays and provide job training in marginalized and environmental justice communities.

FEJA’s rollout was rocky. Funding for equity-focused solar installations went unspent while workforce programs struggled to recruit trainees and connect them with jobs. The pandemic didn’t help. The follow-up legislation, CEJA, expanded workforce training programs and remedied snafus in the original law.

Melissa Gombar is principal director of workforce development programs for Elevate, a Chicago-based national nonprofit organization that oversaw FEJA job training and subcontracts for a Chicago-area CEJA hub. Gombar said many community organizations tasked with running FEJA training programs were relatively small and grassroots, so they had to scramble to build new financial and human resources infrastructure.

“They have to have certain policies in place for hiring and procurement. The influx of grant money might have doubled their budget,” Gombar said. Meanwhile, the state employees tasked with helping the groups “are really talented and skilled, trying their best, but they’re overburdened because of the large lift.”

CEJA, by contrast, tapped community colleges like Richland, which already had robust infrastructure and staffing. CEJA also funds community organizations to serve as “navigators,” using the trust and credibility they’ve developed in communities to recruit trainees.

Richland Community College received $2.6 million from April 2024 through June 2025, and the Community Foundation of Macon County, the hub’s navigator, received $440,000 for the same time period. The other hubs similarly received between $1 million and $3.3 million for the past year, and state officials have said the same level of funding will be allocated for each of the next two years, according to the Illinois Clean Jobs Coalition.

CEJA hubs also include social service providers that connect trainees with wraparound support; businesses like TCCI that offer jobs; and affiliated entrepreneur incubators that help people start their own clean energy businesses. CEJA also funded apprenticeship and pre-apprenticeship programs with labor unions, which are often a prerequisite for employment in utility-scale solar and wind.

“The sum of the parts is greater than the whole,” said Drew Keiser, TCCI vice president of global human resources. “The navigator is saying, ‘Hey, I’ve connected with this portion of the population that’s been overlooked or underserved.’ OK, once you get them trained, send their resumes to me, and I’ll get them interviewed. We’re seeing a real pipeline into careers.”

The hub partners go to great lengths to aid students — for example, coordinating and often paying for transportation, childcare, or even car repairs.

“If you need some help, they always there for you,” James said.

In 1984, TCCI began making vehicle compressors in a Decatur plant formerly used to build Sherman tanks during World War II. A few decades later, the company began producing compressors for electric vehicles, which are much more elaborate and sensitive than those for internal combustion engines.

In August 2023, Gov. JB Pritzker joined TCCI President Richard Demirjian, the Decatur mayor, and college officials for the groundbreaking of an Electric Vehicle Innovation Hub, which will include a climatic research facility — basically a high-tech wind tunnel where companies and researchers from across the world can send EV chargers, batteries, compressors, and other components for testing in extreme temperatures, rain, and wind.

A $21.3 million capital grant and a $2.2 million electric vehicle incentive from the state are funding the wind tunnel and the new facilities where Richland classes will be held. In 2022, Pritzker announced these investments as furthering the state goal of 1 million EVs on the road by 2030.

Far from the gritty industrial environs that likely characterized Decatur workplaces of the past, the classrooms at TCCI feature colorful decor, comfortable armchairs, and bright, airy spaces adjacent to pristine high-tech manufacturing floors lined with machines.

“This hub is a game changer,” said Keiser, noting the need for trained tradespeople. “As a country, we place a lot of emphasis on kids going to college, and maybe we’ve kind of overlooked getting tangible skills in the hands of folks.”

A marketing firm founded by Kara Demirjian — Richard Demirjian’s sister — and located on-site with TCCI also received clean energy hub funds to promote the training program. This has been crucial to the hub’s success, according to Ariana Bennick, account executive at the firm, DCC Marketing. Its team has developed, tested, and deployed digital billboards, mailers, ads, Facebook events, and other approaches to attract trainees and business partners.

“Being a part of something here in Decatur that’s really leading the nation in this clean energy initiative is exciting,” Bennick said. “It can be done here in the middle of the cornfields. We want to show people a framework that they can take and scale in other places.”

With graduation behind him, Honorable is planning the types of hot dogs and sausages he’ll sell at Buns on the Run. He said Tamika Thomas, director of the CEJA program at Richland, has also encouraged him to consider teaching so he can share the clean energy skills he’s learned with others. The world seems wide open with possibilities.

“A little at a time — I’m going to focus on the tasks in front of me that I’m passionate about, and then see what’s next,” Honorable said. He invoked a favorite scene from the cartoon TV series “The Flintstones,” in which the characters’ leg power, rather than wheels and batteries, propelled vehicles: “Like Fred and Barney, I’ll be up and running.”

This reporting is part of a collaboration between the Institute for Nonprofit News’ Rural News Network and Canary Media, South Dakota News Watch, Cardinal News, The Mendocino Voice, and The Maine Monitor. Support from Ascendium Education Group made the project possible.

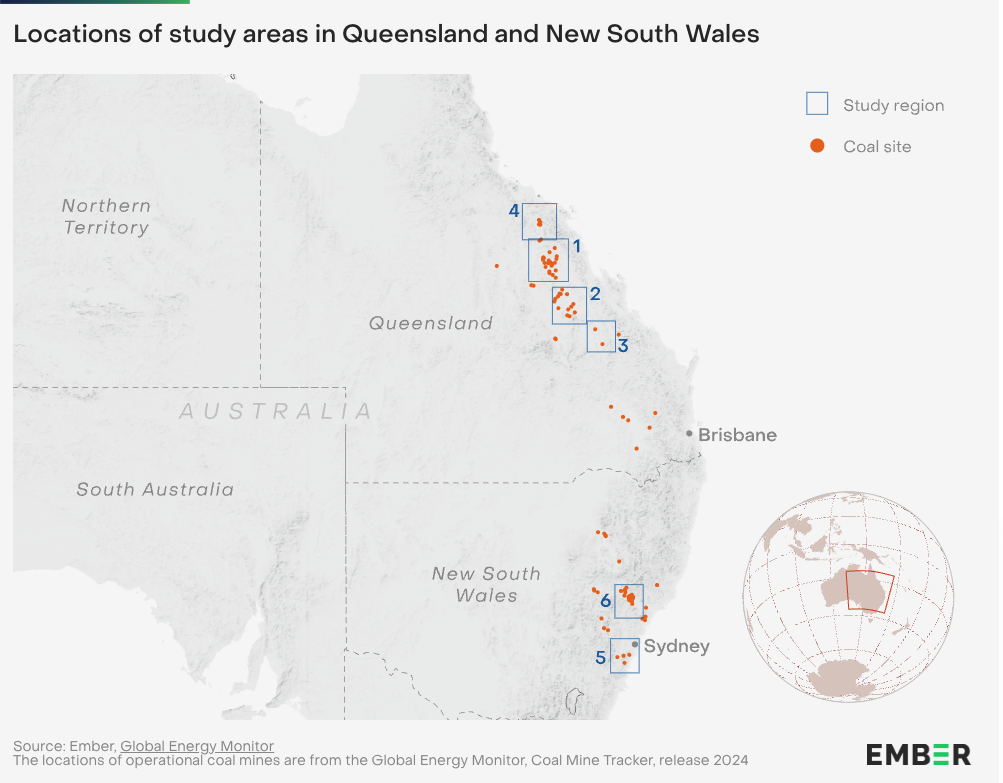

Sydney, 16 April 2025 – A new satellite analysis from global energy think tank Ember has identified 40% greater methane emission from Australia’s coal mines than officially reported. The analysis finds that current reporting methods fail to capture the full scale of emissions, with significant implications for both domestic policy and global steel supply chains.

The collaborative study, based on TROPOMI satellite data analysed by energy intelligence from Kayrros, examined six key coal mining clusters that account for 79% of Australia’s black coal production in Queensland and New South Wales. The analysis, which compared emissions from 2020 and 2021 identified elevated coal mine methane emissions in both states, with a significant discrepancy in New South Wales.

While the study only accounted for two thirds of black coal production in New South Wales, it identified methane emissions within these limited clusters at twice the level that was officially reported state-wide.

Through a comparative assessment of open-cut coal mining in NSW, the study further identified coal mine methane emissions 4-6 times greater than officially reported through company-led estimates.

These findings largely support the diverse array of international and peer-reviewed satellite estimates that have identified considerably higher methane emissions from Australia’s coal mines. This includes a recent aircraft study that identified emissions over Hail Creek mine could be 4 to 5 times than currently reported.

Following a year-long national inquiry into methane measurement approaches in Australia, the Federal government has initiated an Expert Panel to provide advice on atmospheric measurement of fugitive methane emissions in Australia and a departmental review on company-led emissions estimates on open-cut coal mines.

These findings highlight not only the critical importance of these reviews, but the urgency in which Australia needs to improve its emissions reporting, especially within its steel-making coal supply chains.

The study encompassed over 90% of Australia’s metallurgical coal production, a large portion of which is presently exported to the EU. This share of exports will soon be subject to strict emissions reporting requirements under the Carbon Border Adjustment Mechanism. Without necessary improvements, these new regulations could jeopardize significant export opportunities.

This discrepancy in emissions reporting points to the risks of relying on self-reported data and underscores the need for more accurate and independent monitoring.

The study also finds that without major changes to Australia’s existing coal mine methane reporting inventory, the country’s policymakers and international steel-making supply chains will remain in the dark about the total scale of Australia’s coal mine methane emissions.

London, 8 April – The world reached a new milestone as low-carbon sources – renewables and nuclear – provided 40.9% of the world’s electricity generation in 2024, passing the 40% mark for the first time since the 1940s, according to a report by global energy think tank Ember.

Renewables were the main driver of overall clean growth, adding a record 858 TWh in 2024, 49% more than the previous high in 2022. Solar was the largest contributor for the third year running, adding 474 TWh to reach a share of 6.9%. Solar was the fastest-growing power source (+29%) for the 20th year in a row. Solar electricity has doubled in just three years, providing more than 2,000 TWh of electricity in 2024. Wind generation also grew to 8.1% of global electricity, while hydro’s share remained steady at 14% – the single largest renewable source.

“Solar power has become the engine of the global energy transition,” said Phil MacDonald, Ember’s managing director. “Paired with battery storage, solar is set to be an unstoppable force. As the fastest-growing and largest source of new electricity, it is critical in meeting the world’s ever-increasing demand for electricity.”

Ember’s sixth annual Global Electricity Review provides the first comprehensive overview of the global power system in 2024 based on country-level data. It is published today alongside the world’s first open dataset on electricity generation in 2024, covering 88 countries that account for 93% of global electricity demand, as well as historical data for 215 countries.

The analysis finds that, despite the rise in renewables, fossil generation saw a small 1.4% increase in 2024 due to surging electricity demand, pushing global power sector emissions up 1.6% to an all-time high.

Heatwaves were the main driver of the rise in fossil generation, accounting for almost a fifth (+0.7%) of the increase in global electricity demand in 2024 (+4.0%), mainly through additional use of cooling. Without these temperature effects, fossil generation would have risen by only 0.2%, as clean electricity generation met 96% of the demand growth not caused by hotter temperatures.

“Amid the noise, it’s essential to focus on the real signal,” continued Mr MacDonald. “Hotter weather drove the fossil generation increase in 2024, but we’re very unlikely to see a similar jump in 2025.”

Aside from weather effects, increasing use of electricity for AI, data centres, electric vehicles and heat pumps is already contributing to global demand growth. Combined, growing use of these technologies accounted for a 0.7% increase in global electricity demand in 2024, double what they contributed five years ago.

The report shows that clean generation growth is set to outpace faster-rising demand in the coming years, marking the start of a permanent decline in fossil generation. The current expected growth in clean generation would be sufficient to meet a demand increase of 4.1% per year to 2030, which is above expectations for demand growth.

“The world is watching how technologies like AI and EVs will drive electricity demand,” continued Mr MacDonald. “It’s clear that booming solar and wind are comfortably set to deliver, and those expecting fossil fuel generation to keep rising will be disappointed.”

Beyond emerging technologies, the growth trajectories of the world’s largest emerging economies will play a crucial role in defining the global outlook. China and India are already shifting towards meeting their growing electricity needs with clean energy.

More than half of the increase in solar generation in 2024 was in China, with China’s clean generation growth meeting 81% of its demand increase in 2024. India’s solar capacity additions in 2024 doubled compared to 2023. These two countries are at the forefront of the drive to clean power and will help tip the balance towards a decline in fossil generation at a global level.

“Cleantech, not fossil fuels, is now the driving force of economic development,” concluded Mr MacDonald. “The era of fossil growth is coming to an end, even in a world of fast-rising demand.”

Gas stoves increase the chances of getting cancer, with nearly double the risk for kids than for adults.

That’s the stark top-line finding of a recent study by a team of researchers from Stanford University; University of California, Berkeley; and other organizations. The study builds on prior work by the group that found that gas stoves emit benzene, a potent carcinogen also found in secondhand cigarette smoke — even when the cooking appliances are turned off.

“This is a new piece of evidence that shows that gas cookers are toxic for your health and that something needs to be done,” said Juana María Delgado-Saborit, head of the environmental health research laboratory at the Jaume I University in Spain, who was not involved in the study. “We know that benzene exposure is associated with cancer. … [The authors] have put a number on ‘How big is the problem?’”

The work is just the latest in a growing body of peer-reviewed research demonstrating that gas-burning stoves and other appliances harm not only future generations with their planet-warming emissions but also have direct health consequences for people who use them now. These appliances spew a wide range of pollutants, including deadly carbon monoxide and nitrogen oxides linked to respiratory diseases.

Around the U.S., cities and states are taking steps to limit new gas appliances. New York state is pursuing standards to ensure most new buildings will be all-electric. And in California, updates to infrastructure rules and a supportive statewide energy code are already tipping the economics toward all-electric construction.

But efforts to encourage clean cooking also face strong political headwinds. California Gov. Gavin Newsom, a Democrat, vetoed a bill last year to label gas stoves with a health warning. On the first day of his second term, President Donald Trump signed an executive order “to safeguard the American people’s freedom to choose” gas stoves. And at the U.S. Capitol this week, the Republican-controlled House proposed axing federal tax credits that currently make it easier for Americans to choose more energy-efficient, all-electric appliances.

In the new study, the team used benzene measurements from gas stoves in 87 homes, analyzing the health risks for the highest-emitting 5% of stoves by modeling how the carcinogen lingers in different rooms across several types of U.S. housing.

There’s no safe level of benzene exposure. But a common statistical limit for an acceptable level of exposure to the chemical is one person in a million getting cancer over a 70-year lifetime.

Researchers found the added lifetime cancer risk associated with benzene from gas stoves is much higher. For example, in homes that use gas stoves often and without ventilation, the risk from just the benzene that drifted into bedrooms ranged from about two to 12 in a million additional cancer cases for children and from about one to six in a million for adults, according to the modeling.

Accounting for exposure across the whole home, gas stove benzene increased cancer risk for kids by up to 1.85 times the risk for adults.

Ventilating with a high-efficiency range hood or by opening the windows could help decrease the risk, the team found, but couldn’t eradicate it completely.

“The only way to eliminate the exposure is to replace a gas or propane stove with a non-emitting induction or other electric stove,” Rob Jackson, senior author of the study and Earth systems professor at Stanford, told Canary Media.

About 38% of U.S. households cook with blue flames. Across those roughly 47 million homes, the team estimates that 6.3 million Americans are breathing in benzene from their gas stoves at the levels modelled.

How do you know if your gas stove is one of the most polluting? “You don’t,” Jackson said.

Jackson wants policymakers to incentivize a transition to electric cooking. “The switch from dirty fossil fuels to cleaner electricity will save lives and make us healthier,” he said. “The World Health Organization believes that breathing any extra benzene is bad for us, no matter how small the amount.”

“Who wants to breathe more carcinogenic benzene than we have to?”

Maine’s new energy-efficiency plan is projected to lower electricity bills for the state’s residents — even those who don’t directly benefit from its rebate and incentive programs.

The plan, set to go into effect in July, is heavily focused on getting electric heat pumps in as many homes as possible. It comes as other states debate rolling back efficiency programs funded by utility customers as a short-term fix to rising energy prices. Maine’s strategy takes the opposite approach: It leverages investments in efficiency and electrification to lower rates for everyone.

“This is bucking the trend,” said Michael Stoddard, executive director of Efficiency Maine Trust, the agency that administers the state’s energy-efficiency plans. “This is our pathway to managing electricity prices while also transitioning the consumers of our state to the highest-efficiency, lowest-polluting equipment that is available.”

Maine has been an aggressive adopter of home heat pumps in recent years. In 2019, the state set the goal of deploying 100,000 heat pumps by 2025, a target it blew by two years ahead of schedule. The state now aims to get another 175,000 heat pumps up and running by 2027. Maine is also a member of a five-state coalition that is collaborating to boost heat pump adoption, lower prices, and train installers throughout New England.

The state’s new energy-efficiency plan is geared toward continuing this progress. It is centered largely on the idea of “beneficial electrification,” a somewhat jargony term that refers to switching from fossil fuels to electricity wherever the move would save money and cut emissions. There are plenty of opportunities to make that swap in Maine, where roughly half of households keep warm with heating oil, which can be pricey and inefficient.

Over the next three years, the incentives in the plan are forecast to support 38,000 new whole-home residential heat pump systems — including 6,500 in low-income households — and weatherization for 9,900 houses. A low-income household can get rebates of up to $9,000 for heat pump installations, and homes at high income levels qualify for up to $3,000. The incentives do not offer any money for residential fossil-fuel-burning equipment.

This strategy should decrease annual heating costs by more than $1,000 each for homes that switch to heat pumps from oil, propane, or electric baseboard heat, but it is also expected to lower electricity prices across the board, Stoddard said. Efficiency Maine Trust estimates the plan will suppress electricity rates by more than $490 million over the long term.

How? Utilities have certain fixed costs, such as maintaining power lines. To pay for them — and this is a bit of a simplification — they essentially divide the expense by the amount of power they expect customers to use in a year, and add that number to the rate they charge per kilowatt-hour. When more heat pumps come online, power demand goes up, so the fixed costs are spread out over more kilowatt-hours, lowering bills for the average consumer.

Accomplishing that effect depends on finding ways to make sure much of the added demand occurs during off-peak hours, when there is plenty of room for more power to flow along the lines without building out more infrastructure and thus increasing the utilities’ fixed costs. To achieve this timing, Maine’s plan includes demand-response programs that pay consumers for using less energy at peak times, an incentive for low-income residents to buy electric vehicles with chargers that can be set to work at off-peak times, and other measures.

“We’ve already invested a lot of money in the grid, and yet it sits largely unused for many hours of the day,” Stoddard said. “If we can find ways to manage consumption so that it is occurring during off-peak periods, then it will maximize the use of the grid infrastructure and spread the fixed costs of the utility across many more kilowatt-hours.”

Maine’s plan also includes an innovative program that calls for Efficiency Maine Trust to negotiate with retailers and distributors for discounted prices on electric water heaters and for agreements to keep the equipment in stock. The strategy is particularly effective at getting people to switch from fossil-fuel water heaters in moments when their old equipment has failed and they are searching for an affordable, easily available replacement, said Erin Cosgrove, director of policy and programs for the nonprofit Northeast Energy Efficiency Partnerships.

“This program is unique for the Northeast,” she said.

More states have prioritized electrification in their efficiency programs in recent years, said Mark Kresowik, senior policy director for the research group American Council for an Energy-Efficient Economy. Massachusetts, for example, phased out its incentives for oil and gas equipment last year, and Washington, D.C., has also eliminated rebates for fossil-fuel-powered systems and appliances.

“What a lot of programs across the country are doing is recognizing that providing incentives for fossil-fuel-based systems doesn’t achieve their goals,” he said. “Most of the leading states are prioritizing efficient electric appliances like heat pumps going forward.”

Energy-efficiency programs have traditionally centered the big-picture goal of helping consumers lower their energy use to save money and reduce greenhouse gas emissions, whether that energy comes from an oil-delivery truck, a natural gas pipe, or over power lines.

Amid rising concern about climate change, however, more states have looked for ways to amplify the emissions impact of their programs. The solution has been to limit or eliminate incentives for fossil-fuel equipment and lean into electrification, which can often save consumers money and almost always reduce the emissions associated with heating and cooling their homes.

“When you use those additional metrics, you realize some of those old measures don’t make sense anymore,” Kresowik said.

It isn’t easy to trace the flows of electricity across a high-voltage transmission grid that spans 15 states from Louisiana to North Dakota. It’s harder still to differentiate the clean electrons from the dirty ones.

But doing so is necessary for states, companies, and other entities to track real progress toward decarbonization goals. Ultimately, it can be done — so long as you have the right data sources and the willingness to conduct some tricky analysis on power plant emissions and how power moves on the grid.

Just ask the Midcontinent Independent System Operator (MISO), the country’s largest grid operator by geography, and Singularity Energy, a startup developing open-source carbon emissions accounting software. In March, the partners unveiled a “consumed emissions” dashboard, revealing the carbon footprint of electricity within MISO regions, states, and even individual counties, measured on an hour-by-hour basis.

That data is useful for utilities offering “green tariff” programs that promise climate-focused customers a certain share of renewable or carbon-free energy. It also helps states with zero-carbon or renewable energy targets determine the emissions impacts of importing power from out of state versus shuttering fossil-fuel power plants and building clean generation within their own borders.

Those were the two use cases detailed by Jordan Bakke, MISO’s director of strategic insights and assessments, during an April 23 workshop. “Our members and states are pursuing emissions goals both on their own behalf and on behalf of end customers,” he said. “The request that has been given to MISO is to fill that need for temporal, spatial, and timely granularity of emission estimations across our footprint.”

Greg Miller, research and policy lead at Singularity, said similar approaches could help companies that have contracted with wind and solar farms or nuclear power plants to determine how much of that carbon-free power is actually reaching their data centers, factories, and office buildings from hour to hour. That’s a big deal for corporate clean-energy buyers like Google and Microsoft that have committed to serving a growing amount of their enormous power needs with carbon-free electricity.

Singularity is one of many companies working on providing these increasingly complex grid-emissions calculations.

Software providers such as Electricity Maps, Flexidao, and Kevala are tracking power plant emissions and energy flows across swaths of Europe and North America. Companies like REsurety and WattTime have built “marginal emissions” methods to calculate the impact of clean energy generated at different times on regional grids. Major clean energy investors like Quinbrook Infrastructure Partners and HASI are building carbon-tracking methods. And the EnergyTag international consortium has developed “granular certificate” standards to track hourly emissions associated with clean energy contracts.

But MISO’s consumed-emissions dashboard brings a new level of detail, Miller said. “We can’t trace individual electrons, just like we don’t trace water molecules in a river,” he said. “But we can trace larger power flows from generators to the loads where these flows are going.”

Two key data inputs feed Singularity’s emissions outputs for MISO’s new dashboard. The first is its fine-grained estimates of how much carbon is being emitted from individual fossil-fuel power plants — a seemingly simple calculation that’s actually quite complicated to nail down.

“Every generator’s efficiency is described in its heat rate — how much fuel it needs to burn to generate a unit of electricity,” Miller explained. Heat rates change from hour to hour, depending on factors ranging from the outdoor temperature to whether generators are running at maximum efficiency or are just being started up.

Singularity worked with nonprofit and research partners on a project called the Open Grid Emissions initiative to develop a method for calculating those constantly shifting emissions rates using public data and open-source methodologies. In the past year, it has developed a way to use available historical data to estimate those emissions changes in real time, Miller said. Experts in the field can check the methodology themselves “because it’s all modeled off publicly available data.”

The second key source of information at play for MISO’s dashboard is more proprietary — the power-flow data used to assess how much electricity from fossil-fueled power plants and all other sources is reaching the nodes on MISO’s transmission network on an hourly basis. That includes “information about how much power is getting generated and injected to the grid, how much power is getting withdrawn for loads, and the power flows for each transmission line in that network,” Miller said.

The platform that Singularity developed for running that analysis, dubbed CarbonFlow, uses open-source methods to reach its conclusions, he said. But the input data itself is kept confidential, both to protect the competitive interests of the power plant operators in MISO’s energy markets and to comply with federal mandates meant to protect critical infrastructure.

The end result isn’t as complete a picture as some might imagine, Miller emphasized. MISO only tracks power down to the individual substations that convert high-voltage power to lower voltages for use on distribution grids, for example, not to individual customers.

And while the dashboard’s emissions data will be made available on a near-real-time basis at the regional and state level, users have to wait a month after the end of each quarter to look at the hourly data for counties. That’s to avoid revealing operational information about fossil-fueled power plants in those counties to competitors, at least in timeframes that would allow them to act on it in ways that could give them unfair advantages.

Nonetheless, publicly accessible data at the hourly and county level is breaking new ground in the world of grid carbon accounting, Miller said. “This may be for only one region in the U.S. But it proves it’s possible to calculate this data — and other grid operators can do it too, if this data were required more broadly in accounting standards.”

Kathleen Spees, a principal with consultancy The Brattle Group, would like to see MISO and Singularity’s approach picked up by more grid operators. “At the least, they have to start providing the data,” she said.

Brattle was hired by the Illinois Commerce Commission to help develop the state’s Renewable Energy Access Plan, a road map for how the state can meet its mandate to reach 100% carbon-free power by 2045. Illinois already gets more than half of its power from in-state nuclear plants and is aiming to dramatically expand its use of solar and wind power from both within and outside its borders.

“But Illinois, like many states, is highly interconnected with its neighbors,” Spees said. “You can’t just reduce the fossil emissions in your state and say you’re done.” In fact, “if you ramp down gas in Illinois and ramp up coal somewhere else, that’s counterproductive” to the state’s carbon-cutting goals.

That’s why grid operators must be in the picture. The energy markets they run don’t account for carbon emissions today, although some grid operators are starting to make certain emissions data available to participants. But “over time, they have to create the mechanisms for trade,” Spees said, “so that the states that value green energy and avoiding carbon emissions have valid signals.”

Utilities and regulators need hard data to start translating these commonsense understandings of how grids work into real policy decisions with dollars and cents attached to them, Spees said. “We’re not talking minor academic interest here — we’re talking real money. What fraction of the enormous amount of capital going into our sector can ignore carbon implications? It has to be validated.”

That’s going to be complicated, particularly in Illinois, which is served both by MISO throughout most of the state and by PJM Interconnection, a grid operator serving 13 states from Virginia to the Chicago region. But the work has to start somewhere, and “the contribution that MISO is making here is really pushing the envelope in terms of the technical advance of what they can offer,” she said.

Singularity CEO Wenbo Shi pointed out another key use case for MISO’s data: informing “green tariff” programs that are available in most states. Green tariffs offer customers — usually corporate buyers looking to add clean power — the option to pay higher rates to secure a greater share of renewable or carbon-free electricity than what is available from the utility’s general mix of generation.

But to balance things out, each transfer of clean-power ownership rights from a utility to a customer must then be subtracted from the utility’s mix for other customers, lest it be “double-counted” as the same resource belonging to multiple end users.

“Once you can do that, you know exactly who gets what, and what’s left,” Shi said. “This eliminates the risk of double-counting.” The new MISO dashboard can help utilities make these calculations, he said. To accurately allocate clean electricity to the right customers, utilities must first understand their whole supply mix — and those that are part of a regional grid like MISO also need to factor in the energy that they purchase from the wholesale market.

Singularity has worked with utility Southern Co. to deploy such a system to provide customers with unprecedented visibility into their energy mix and emissions, Shi said. In MISO, one of the first users of the grid operator’s consumed-emissions data-tracking capabilities has been utility Entergy Arkansas, which offers green tariffs for customers such as steelmakers.

To be clear, MISO is explicitly not using its consumed-emissions data to inform “market-based” carbon accounting, Miller said. That’s the term for contractual arrangements that establish ownership of a unit of clean energy, such as the renewable energy certificates created under Greenhouse Gas Protocol Scope 2 Guidance, the gold standard in emissions accounting.

At the same time, the GHG Protocol is in the midst of changes that may make the kind of tracking Singularity is doing quite useful for market-based accounting, Miller noted.

Today, companies can offset emissions associated with their electricity use through clean energy purchases that are averaged out over the course of a year, and which can come from sources far removed from a company’s power-using facilities.

Those loose accounting rules helped enable corporate spending in building more clean energy when solar and wind were rare and expensive, and when linking their generation and delivery to a corporate customer’s actual energy consumption was less important. But clean energy has now become the cheapest and most common source of new grid capacity, which means that when and where new clean energy is being built — and whether it’s actually being used by the facilities of the companies claiming it — matters much more.

The data center boom is pushing these issues to the forefront for utilities and regulators. Data center expansions being proposed to feed the AI ambitions of tech giants are threatening to overwhelm the capacity of power grids in key markets across the country, including states like Wisconsin that lie within MISO’s grid footprint.

These ballooning load forecasts are driving utilities and grid operators to propose fast-tracking new fossil gas-fired power plants. But that threatens to undermine the aggressive clean-energy targets set by Amazon, Google, Meta, Microsoft, and other companies driving the data center boom, giving them impetus to seek cleaner options.

Just how the GHG Protocol’s rules on clean electricity accounting should work is a contentious subject, with major clean-energy buyers split on issues such as the well-publicized debate over whether they should aspire to 24/7 clean power at their facilities or invest in projects that will reduce the most emissions.

Singularity hasn’t waded into those debates, Shi said. But the technology that it and competing firms are developing can provide the tools necessary to allow clean-energy buyers and states to go beyond high-level and potentially misleading understandings of their emissions — and get closer to actually measuring those crucial figures.

Singularity is “tracing everything, whether it’s based on power flows or contracted,” Shi added “There are technologies that are being deployed that can solve that problem.”

Companies making and deploying lithium-ion batteries in the U.S. recently gathered in Washington, D.C., to ask the federal government for the policy support they say they need. Their request came alongside a big promise: to cumulatively spend $100 billion by 2030 to build a self-sufficient, all-American grid battery industry.

“Within five years, and with $100 billion in investment, we can satisfy 100% of U.S. demand for battery storage,” said Jason Grumet, CEO of the American Clean Power Association, a trade group.

“This is unquestionably an ambitious commitment, but it is absolutely achievable if the private and public sectors work together,” he said. The $100 billion promise represents a major increase in the $10 billion to $15 billion that the American Clean Power Association estimates was invested in U.S. grid battery manufacturing and deployment last year.

As recently as a few months ago, industry analysts largely agreed that a domestic ramp-up on the scale of what Grumet proposes was at least possible, if not inevitable. Lucrative federal tax credits for companies that build and deploy clean energy technology within the nation’s borders have helped close the price gap between U.S.-made batteries and those made in China, the world’s main supplier of lithium-ion battery modules, cells, and materials.

These tax incentives, created by the 2022 Inflation Reduction Act, have also helped bolster the economics of installing large-scale batteries alongside solar power. Solar and batteries are by far the fastest-to-deploy option for utilities seeking to meet rising electricity demand from data centers, factories, electric vehicles, and broader economic growth. The two energy sources have dominated new additions to the U.S. grid in recent years.

But that’s changing under the Trump administration.

Republicans in Congress may kill the Biden-era tax credits that make domestic battery manufacturing possible. The Department of Energy Loan Programs Office, which has lent huge sums to battery manufacturers like Eos and Kore Power, could soon be shuttered or radically scaled back. And President Donald Trump’s aggressive and ever-shifting tariffs are making it more expensive for manufacturers to produce batteries in the U.S., since the duties raise the costs of everything from cells imported from China to general-purpose materials like steel and aluminum.

On Monday, China and the U.S. announced they’d temporarily ease tariffs on one another, but the situation has not been permanently resolved and leaves tariffs on Chinese imports at 30%. Manufacturers and developers still lack clarity about what the underlying economics of their business will look like months from today.

As Grumet conceded in a briefing with reporters before the American Clean Power Association’s D.C. media event in April, “there is a remarkable tension right now between probably the best fundamentals for investment in the energy sector that we’ve seen in a generation and the greatest amount of uncertainty that we’ve seen in a generation.”

When it comes to plugging batteries into the U.S. power grid, tariffs are the most immediate threat by far. The impacts are already showing up in sagging forecasts and postponed projects.

In February, the U.S. Energy Information Administration predicted the country would deploy more than 18 gigawatts of batteries in 2025, up from 11 gigawatts in 2024, continuing what’s been a meteoric increase over the past several years. But the forecast for 2025 grid battery additions has fallen in recent months, at least according to the latest analysis from the American Clean Power Association and consultancy Wood Mackenzie, which is tucked into the end of the clean energy industry group’s fact sheet for its $100 billion-by-2030 investment pledge. They predict that a little over 13 GW of energy storage will be plugged into the nation’s grid this year.

Several factors play into that drop-off, but the primary one is that nearly 70% of lithium-ion batteries in the U.S. came from China last year — and that tariffs on Chinese lithium-ion batteries and components had spiked to 156% as of last month, according to BloombergNEF.

Monday’s news that the U.S. and China had agreed to a 90-day pause on their dueling tariffs means that the blanket 145% tariffs that the Trump administration had imposed on China in April will fall to 30% as of Wednesday — at least if the deal holds.

Now, once again, energy storage companies will be recalibrating the economics of their projects, almost all of which currently rely on battery materials or components from China.

“For the next five to seven years, there is no cost-effective, time-critical alternative to battery storage to meet domestic electricity demand,” said David Fernandes, chief financial officer of OnEnergy, a grid storage and microgrid developer with 120 megawatt-hours of projects in operation and 3 gigawatt-hours in development across the U.S. and Latin America. “That means cells from China.”

Tariffs on Chinese imports simply mean the batteries that the U.S. grid needs “will just be more expensive,” he said, which will in turn drive up electricity prices.

Regardless of where tariffs settle, they have already disrupted some grid storage projects.

Take Fluence, a major U.S.-based energy storage provider that’s made more than $700 million in commitments to manufacture battery cells and modules in the U.S. to date, according to John Zahurancik, Fluence’s president of the Americas. In its second-quarter earnings call last week, the company reported a significant downward revision in its 2025 revenue forecasts, driven by decisions to “pause U.S. projects under existing contracts” and “defer entry into pending contracts until there exists better visibility and certainty on the tariff environment.”

More delays are on their way, according to Ravi Manghani, senior director of strategic sourcing at Anza Renewables, a data analytics firm focused on solar and energy storage. Of the batteries bound for grid storage deployments in the U.S. in 2025, roughly half are “at risk of getting delayed or renegotiated to make the economics work in 2026 and beyond,” he said.

Some larger-scale projects scheduled to come online this year have likely already brought their batteries into the country, escaping the tariff premium, Manghani said. But many that are procuring batteries now for delivery from late 2025 to early 2026 “are indefinitely postponed until we get more clarity around where the tariffs end up, and what happens to non-Chinese manufacturing at large,” he said.

Projects that are being built as part of state-regulated utilities’ broader generation and grid plans may be able to absorb cost increases, he said. But “merchant projects” that are operated by independent power producers in competitive energy markets are “still figuring out if they can pencil out,” he said.

In a Monday email, Manghani updated his view based on the latest news of a U.S.-China trade rapprochement.

“We will have to see if suppliers can actually ship out within this 90-day window,” he wrote. The determination of which countries end up having the most affordable battery components in the long run “will depend not only on which countries have tariffs, but where the tariff percentages exactly land.” Trump’s seesawing on tariffs “just adds another layer of complexity for long-term investments,” Manghani added.

Those dynamics could crimp the rapid pace of development in the competitive energy market of Texas, the country’s grid energy storage leader.

Stephanie Smith, chief operating officer at grid battery developer Eolian, said during the American Clean Power Association’s April briefing that Texas has been well-served by its fleet of grid batteries, which have helped the state ride through summer heat waves while avoiding grid emergencies that have plagued it in the past.

But it’s going to be harder for Texas, and the rest of the country, to keep rapidly installing grid batteries in the face of rising prices for Chinese batteries. Eolian is scrambling to “source as much outside of China as possible right now” to deal with the tariffs, Smith said. But “obviously, there are some limitations on that.”

Despite the uncertainty and rising prices, utilities and grid operators desperate to meet rising electricity demand have little choice but to build more batteries, said Gary Dorris, CEO and cofounder of clean energy-focused consultancy Ascend Analytics. That’s because the alternative — new gas-fired power plants — takes much, much longer to build.

Manufacturers of the turbines used in gas power plants are reporting up to four-year wait times for customers seeking to build power plants not already in the works, Dorris told Canary Media in an email. Solar panels and batteries, by contrast, can be ordered, shipped, and deployed in less than a year.

While the specifics of Trump’s tariffs matter — there is, after all, an enormous difference between 156% and 30% tariffs on China — at this point the hardest thing for manufacturers is “the confusion surrounding” trade policy, Dorris said.

Firms are asking, “What are the goals? Will they stay in place? How will other countries react?” he said. “This has created a lot of uncertainty, which suppresses appetite for making large, irreversible capital investment decisions.”

This unpredictability, paired with the immediate price hikes on imported materials and equipment needed to build and expand factories, has hurt the U.S. manufacturers that the Trump administration’s tariffs are ostensibly meant to help. These impacts are particularly dangerous for the still-nascent U.S. battery manufacturing sector.

The American Clean Power Association is tracking 25 major projects to build or expand grid-scale energy storage factories in the U.S., of which 11 are in operation or under construction. Much of this manufacturing capacity is for battery modules, meaning it continues to rely on Chinese battery cells and materials.

“The domestic supply chain is unfortunately going to be at the receiving end of the tariff,” Manghani said. “A lot of the raw materials that would go into domestic batteries, as well as the manufacturing equipment you need to build these cell factories, are still slated to come from China. We don’t have a lot of alternatives yet.”

That dependence on Chinese-made cells underscores just how vulnerable today’s battery-manufacturing industry is to tariffs, Grumet said. Some domestic facilities are also starting to make those cells and refine and manufacture battery materials.

Those include the facilities that Fluence has invested in that are making battery modules, cells, and associated equipment in Utah and Tennessee. It also includes Tesla’s expanding cell-manufacturing capacity from its factories in Nevada and Texas, and its lithium-refining facility in Texas.

Speaking at the American Clean Power Association’s D.C. event, Michael Snyder, Tesla’s vice president of energy and charging, highlighted the EV and grid battery manufacturer’s advances in lithium iron phosphate cells. These cells are safer and easier to source materials for than nickel manganese cobalt cells and have become the favored technology for EV batteries and grid batteries alike. Today, Chinese companies make 99% of the world’s lithium iron phosphate cells, according to Benchmark.

“We think we’re going to be the first non-Chinese company making these cells at scale, and we know there are a lot of other companies working on that as well,” Snyder said. South Korea-based LG Energy Solution in February announced plans to invest $1.4 billion in U.S. lithium iron phosphate cell production for grid storage, which will take place at the firm’s existing factory in Holland, Michigan.

But those efforts are in their early stages, and they’ll only succeed if they have customers to buy their products — a prospect made less certain by the chill settling in over grid battery deployment.

The Trump administration’s hostility to Biden-era climate policy and its broad support for fossil fuels is undermining investor confidence in the continued growth of U.S. grid battery markets, with consequences for the domestic manufacturing projects that would aim to supply them. The first three months of 2025 saw cancellations of billions of dollars in planned battery cell-manufacturing investment from Freyr Battery (now T1 Energy) in Georgia and Kore Power in Arizona.

But the bigger threat to U.S. clean energy deployment and manufacturing is the possibility that Republicans in Congress will undo the tax credits created by the 2022 Inflation Reduction Act to benefit companies that build and deploy lithium-ion batteries and many other clean energy technologies.

Republicans in Congress have pledged to extend tax cuts passed during the first Trump administration that will add trillions of dollars to the federal deficit, and they are hunting for federal spending cuts to make that possible. The estimated $780 billion in clean-energy tax credits is a tempting target. Some Republicans are arguing to keep the tax credits that undergird major investments in factories and power projects in their districts, while others have called for eliminating them completely.

These incentives currently boost the economics for grid battery projects with a 30% base credit on the cost of the up-front investment, but developers can get more if the projects obtain a certain amount of materials from domestic suppliers or if they are built in “energy communities” that face losses in jobs and economic activity due to closures of fossil fuel infrastructure. The tax credits have accelerated storage deployments — and boosted demand for batteries from U.S. manufacturers.

But for battery manufacturers, the most vital piece of policy is the 45X Advanced Manufacturing Production tax credit. That credit is tied to every unit of battery module, cell, component, and material produced domestically, at a level designed to make them cost-competitive with Chinese products.

45X has been the primary spur for investors committing hundreds of billions of dollars to U.S. clean technology manufacturing. It’s hard to see how those investors could keep their commitments if that support went away — and harder still to see how any new factories will be planned now, while the fate of that incentive is up in the air.

Road transport is responsible for around three-quarters of global carbon dioxide emissions from transport. Switching from petrol and diesel to electric vehicles is an important solution to decarbonize our economies.

This chart shows the change in share of new cars that were electric in China, the European Union (EU), and the United States (US) between 2020 and 2023. This includes fully electric and plug-in hybrid cars, though most are fully electric.

In 2020, electric cars were rare everywhere. But by 2023, over one-third of new vehicles in China were electric, compared to less than a quarter in the EU and under a tenth in the US.

While we only have annual data up to 2023, preliminary figures suggest that in 2024, electric cars outsold conventional ones for the first time in China.

Explore data on electric car sales for more countries →

Illinois’s ambitious clean energy transition, which mandates a phaseout of fossil-fuel power by 2045, depends on adding large amounts of energy storage to the grid. This is especially true now with the proliferation of data centers. Utility-scale battery installations will be key to ensuring that renewables — along with the state’s existing nuclear fleet — can meet electricity demand.

That’s why energy companies and advocates are racing to get legislation passed that incentivizes the addition of battery storage on the grid, before the state legislative session ends May 31.

On May 1, a state regulatory commission released a report outlining its recommendations for a summer procurement of grid-connected battery storage by the Illinois Power Agency, which procures power on behalf of utilities ComEd and Ameren.

Clean energy industry leaders and advocates have been pushing for storage incentives for years and were disappointed that such provisions were not included in the 2021 Climate and Equitable Jobs Act.

In a January lame-duck session, the legislature passed a narrow bill that ordered the Illinois Commerce Commission — which regulates utilities — to hold stakeholder workshops to study grid storage capacity needs and possible incentive structures. The resulting report is meant to inform legislation that backers hope will pass this spring and lead to the storage procurement this summer.

In the report, the commission noted that energy storage would reduce prices, increase grid reliability and resilience, avoid costly grid upgrades and power plant construction, facilitate renewable energy deployment, and create “macroeconomic benefits” like jobs and investment in local infrastructure.

Jeff Danielson, vice president of advocacy for the Clean Grid Alliance, whose members include renewable power and battery storage developers, said the plans are long overdue.

“Wind and solar are important, but for the grid itself to be holistically sustainable requires battery storage,” Danielson said. “Battery storage has value. It’s time for Illinois to add this tool in its toolbox for a sustainable grid.”

The report recommends that the Illinois Power Agency do an initial procurement for 1,038 megawatts of grid-connected storage this summer — a total that the commission says should include 588 MW in the PJM Interconnection regional transmission organization’s territory in northern Illinois and 450 MW in the territory managed by the Midcontinent Independent System Operator. Additional procurements by the end of 2026 should incentivize the construction of 3 gigawatts of storage to be in operation by 2030, the report says. And it calls for setting a second target for additional storage beyond 2030.

Advocates and industry groups said they are generally happy with the proposals, though energy storage and renewable industry leaders were asking for a 1,500-MW initial procurement and up to 15 GW of storage by 2035. The commission’s draft report had called for only 840 MW in an initial procurement, but after hearing public comments, it upped the amount in the final version. The industry also wants incentives for both stand-alone storage and storage paired with renewable energy, but the commission’s report recommends that the initial procurement only be for stand-alone batteries.

“It’s now up to lawmakers to meet the moment and provide both a short-term and long-term solution to high utility bills,” said Danielson. “Energy storage is the right answer, at the right time, for the right reasons.”

It’s crucial that legislation pass this year since storage developers are seeing increasing demand nationwide and deciding where to invest, said Samarth Medakkar, Illinois lead for Advanced Energy United, an industry group whose members include renewable and storage companies.

There are already gigawatts of proposed battery storage projects in Illinois that are waiting for approval from the Midcontinent Independent System Operator to interconnect to the grid. Those projects need funding to progress and meet deadlines set by the grid operator to stay in the queue, Medakkar explained.

“There’s competition — developers are looking at Illinois as a market, but they’re looking at other states as a market too,” Medakkar said. “We need to make these as least risky as possible. Procurement would give them confidence to make the payments to stay on course in the queue. We can send a signal to developers that if you make these nonrefundable payments, we will have a market for energy storage and you can bid your project into this market.”

A letter from storage and renewable developers to the chief of the Commerce Commission’s Public Utilities Bureau, offering comments on the draft report, noted that storage projects take seven to 10 years to develop, so the state needs to act soon to procure the grid battery capacity it wants online beyond the 2030 date discussed in the study.

“Developers across the country are facing a challenging federal environment, including newly announced tariffs,” the letter says. “As a result, many developers are now prioritizing their limited capital across fewer projects — focusing on states with established and supportive markets, and divesting from states that are not as far along.”

The commission’s report proposes incentivizing storage through a market for indexed storage credits, structured similarly to the state’s renewable energy credit program that has fueled a boom in solar power and, to a lesser degree, wind power. Under this design, the developer or owner of the storage is essentially allowed to sell credits for funds awarded by the state and collected from utility customers.

New York is the only other state with a storage credit market, according to experts. If Illinois passes legislation and launches the program this summer, it will be rolling out around the same time as the nascent program in New York, scheduled to hold its first procurement by the end of June. In other states, grid storage is supported through a structure known as tolling agreements, wherein utilities or other companies build and operate battery installations on the grid, and utility customers are essentially charged for their use.

In both models, residents pay for the new storage through their electric bills — just as they pay for renewables under Illinois’ existing renewable energy credit program. The Commerce Commission found that 3 GW of storage incentivized through credits would cost utility customers between 39 cents and $1.69 per month, though storage would also lead to bill savings by avoiding costlier investments in generation.

Danielson said battery storage developers prefer a tolling structure since it is a much more common and potentially more effective practice. It would be “pretty odd” if Illinois did not offer that option, he said, though ultimately, companies are eager to get legislation passed in whatever way possible.

“We’re not making a judgment about which one’s better. It just needs to be a choice,” Danielson said.

James Gignac, Midwest policy director of the Union of Concerned Scientists, said clean energy advocates are on the same page.

“I would be hopeful we can identify a way to use tolling agreements because the more options we can offer to the market, that means we’ll be getting more companies interested in proposing projects,” Gignac said. “That’s good for consumers and provides more competition. We may learn that the indexed storage credit approach is producing a certain type of project, and a tolling agreement could be offered to attract a different size of facility or different use case.”

Danielson noted that California, New York, and Texas have the largest amounts of on-grid storage in the country, and Illinois could be poised to join them.

“One thing those three states have in common is density of businesses and people,” Danielson said. “There is no good reason why Illinois should be lagging these other states in terms of these projects being built.”

The battery storage workshops this spring were “eerily similar to what we just did” in the leadup to CEJA, Illinois’ 2021 climate law, he continued. “For five years, these ideas have been studied and bantered about. Now demand is higher for sustainable power, the technology is better, [and] the costs are lower, which means Illinois leadership matters now more than ever.”

One subject of debate is whether the storage incentives should include the same focus on equity that has characterized Illinois’s existing clean energy laws – CEJA and the Future Energy Jobs Act before that. Workforce training and solar deployment programs created by these laws prioritize people and communities impacted by fossil-fuel power plants, the criminal justice system, and other indicators of inequity. The commission’s draft report recommended that storage procurement exclude such equity provisions, in part because battery storage-related jobs include dangerous, high-voltage conditions.

Members of the Illinois Clean Jobs Coalition objected, noting that solar and wind jobs also involve high voltage. In comments to the commission on behalf of clean energy groups, Gignac stated that solar and wind developers can request waivers under the state law if they can’t find equity-qualifying candidates for certain jobs; meanwhile, there is “no evidence” that equity-eligible employees and contractors would be unqualified for storage development.

The final recommendations encourage the same equity standards for storage development as for renewables, a change lauded by advocates.

“This will help ensure that Illinois is advancing equitable workforce opportunities in battery storage facilities alongside other clean energy technologies such as wind and solar,” said Gignac.

Clean energy advocates and industry representatives plan to encourage lawmakers to amend or introduce legislation based on the findings in the Commerce Commission’s report, they said

The Illinois Clean Jobs Coalition, which helped pass CEJA, is pushing for a new energy omnibus bill this legislative session. Members said they are hoping to work with industry to add storage-related language. Meanwhile, renewable and storage industry stakeholders are backing a bill that would require the Illinois Power Agency to procure energy storage totaling 15 GW online by 2035, and require utilities to charge customers to fund it. The bill would allow both credit and tolling incentive structures.

Samira Hanessian, energy policy director of the Illinois Environmental Council, said she is “cautiously optimistic” about a bill incentivizing storage passing this legislative session.

“I’m feeling a lot more positive around how storage is now coming up in most conversations with legislators and in our coordination spaces,” Hanessian said. “To me it’s become a very real policy issue that we are on track to address this session.”

The Trump administration has launched an all-out assault on American energy-efficiency efforts that have saved consumers billions of dollars and eased the transition away from fossil fuels.

From proposing to eliminate the popular Energy Star and Low Income Home Energy Assistance programs to firing staff and delaying building efficiency standards, President Donald Trump’s moves threaten to upend decades of progress on making appliances and structures do more with less energy.

“Energy efficiency is the best, fastest, cheapest way to lower energy costs,” said Mark Kresowik, senior policy director at the nonprofit American Council for an Energy-Efficient Economy. “That’s something that, ostensibly, the Trump administration said they want to do.”

Trump’s actions could undercut his own promise to halve energy bills during his first 18 months in office, as well as hamper climate action.

Efficiency is an undersung tool for reducing carbon pollution. If the globe maximized efficiency efforts, it could phase out fossil fuels by 2040, according to nonpartisan clean energy nonprofit RMI. It’s typically the lowest-cost way utilities can meet power needs, a crucial consideration as electricity bills rise around the country. And with electricity demand forecast to climb to record highs due in large part to the rapid expansion of AI data centers, efficiency could take on new importance as a way to get more out of every unit of energy.

One of the most recent and notable moves against efficiency programs is the Environmental Protection Agency’s plan to kill Energy Star. The EPA announced the decision to shutter the program at an all-hands meeting last week, according to The Washington Post, though the agency has not publicly confirmed the decision.

Energy Star is a voluntary program that certifies the most efficient appliances available to American households and businesses. Products that have earned the iconic aqua-blue label span dozens of residential and commercial categories, including data center storage, water heaters, clothes dryers, furnaces, and heat pumps.

The program has been wildly successful. Since 1992, Energy Star has prevented 4 billion metric tons of planet-warming greenhouse gas emissions — equivalent to a year’s pollution from 933 million cars — and helped consumers save more than $500 billion in energy costs. For every dollar the federal government spends on the program, consumers save a whopping $350.

Axing Energy Star would also scramble eligibility for federal and local incentives that require the program’s seal of approval, such as the $2,500 tax credit for home builders.

More than 1,000 companies, building owners, and other organizations have come out in support of Energy Star. “Eliminating it will not serve the American people,” a coalition of appliance manufacturers and industry leaders wrote in a letter to EPA head Lee Zeldin, Inside Climate News reported.

Energy Star isn’t the only federal energy-efficiency program in peril.

In April, the Department of Health and Human Services fired the more than two dozen staff members who administered the Low Income Home Energy Assistance Program (LIHEAP), according to Harvest Public Media. The initiative provided financial support to nearly 6 million households in 2023 across all 50 states and the District of Columbia, helping vulnerable Americans cover utility costs, undertake energy-related home repairs, and make weatherization upgrades that reduce energy bills.

Released in early May, the president’s “skinny” budget proposal for the next fiscal year recommends shuttering the $4 billion program, which in particular helps households with older adults, individuals with disabilities, and children.

Cutting program funding and failing to hire back staff may affect more than energy bills, according to advocates.

“The elimination of the staff administering LIHEAP could have dire, potentially deadly, impacts for folks who will not be able to safely cool their homes as we enter what is predicted to be another historically hot summer,” Amneh Minkara, deputy director of Sierra Club’s building electrification campaign, said in a statement.

President Trump and Congress are also targeting efficiency standards for appliances sold in the U.S. The president just signed four resolutions to undo a handful on Friday.

That’s despite both Democrats and Republicans saying they want appliance standards. According to an April poll by Consumer Reports, 87% of Americans, including four out of five Republicans, agree that new home appliances for sale in the U.S. should be required to achieve a minimum level of efficiency.

Part of the administration’s strategy will likely include simply not enforcing the standards, according to the Appliance Standards Awareness Project. Last month, ProPublica reported that Elon Musk’s Department of Government Efficiency team had “deleted” the consulting contract that the Department of Energy relies on to develop and enforce these rules. But the item subsequently disappeared from DOGE’s online “wall of receipts,” making its status cloudy.

Beyond appliances, the Trump administration is snarling rules for more efficient buildings, too.

In March, the Department of Housing and Urban Development delayed compliance deadlines set by a landmark 2024 measure that requires certain new homes purchased with federally backed mortgages and new HUD-funded apartments to meet updated building energy-efficiency codes. The rule would save single-family households an average of $963 per year on energy bills, according to the agency’s estimates, and affect up to a quarter of new homes nationwide, per RMI. The administration wrote in a recent court filing that it is “actively considering whether to revise or revoke” the rule.

In April, the Department of Energy proposed to indefinitely delay implementing efficiency standards for manufactured homes that would reduce average annual energy costs by $475.

And on May 5, the agency punted by a year the compliance date for a standard that would ensure federal buildings that are built or significantly renovated between this year and 2029 slash on-site fossil-fuel use by 90%. In 2030 and beyond, the standard requires new and renovated federal buildings to be all-electric.

That rule, Energy Star, and many of the other energy-efficiency efforts under threat are congressionally mandated — and not all Republicans are rolling with the administration’s attacks.

In a statement earlier this month, Sen. Susan Collins, a Republican from Maine, said she had “serious objections” to some measures in Trump’s budget blueprint, including the elimination of LIHEAP. Collins, who chairs the Senate Appropriations Committee, noted that “ultimately, it is Congress that holds the power of the purse.”

Corrections were made on May 12, 2025: This story originally misstated that consumers buying heat pumps must purchase Energy Star-certified equipment to qualify for the $2,000 25C federal tax credit. The tax credit does not base eligibility on Energy Star, but rather on the Consortium for Energy Efficiency specifications. The story also originally misstated that a handful of resolutions to undo federal efficiency standards await the president’s signature. President Trump signed the resolutions on May 9, 2025.